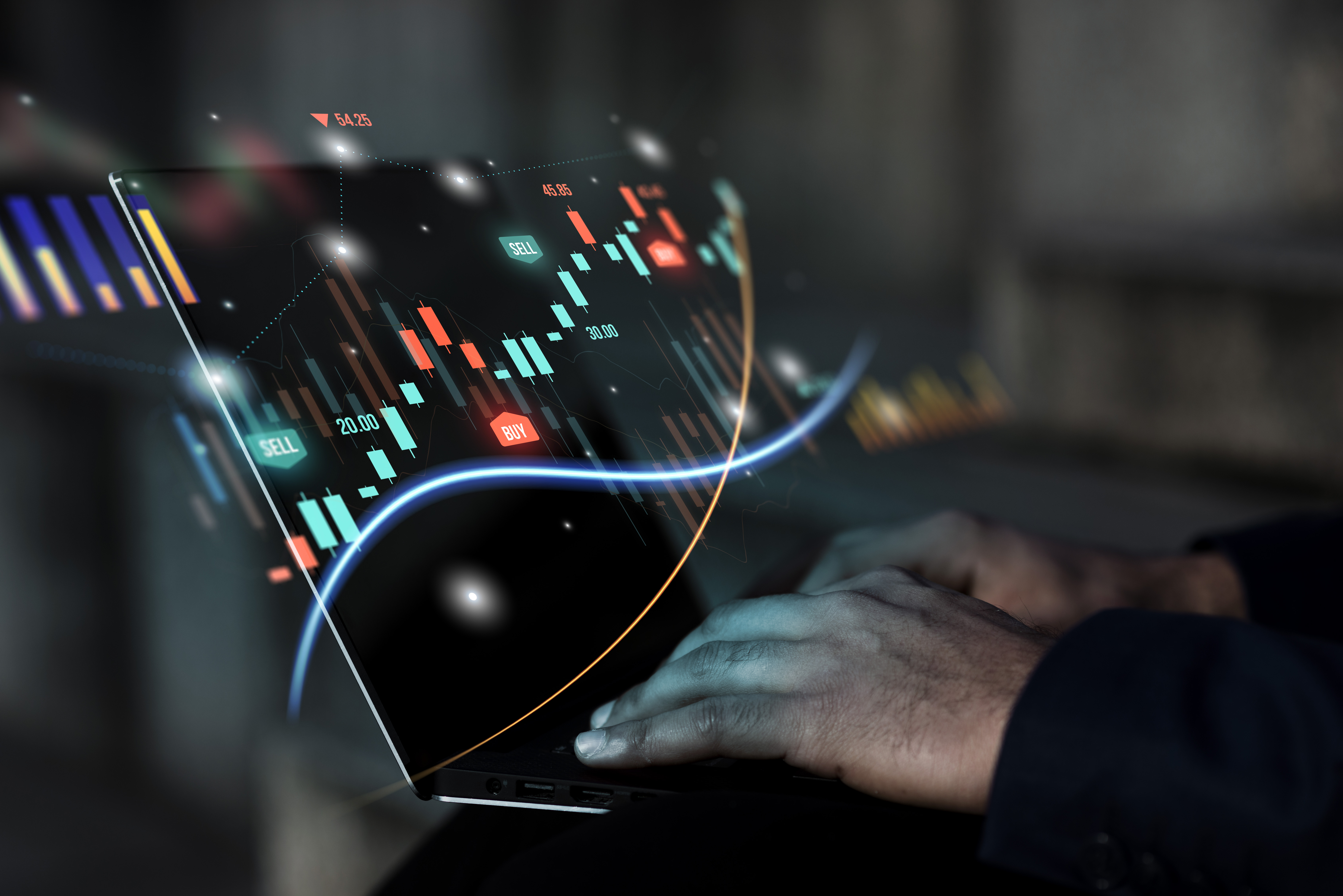

The bid price is the highest price that a particular buyer is willing to pay for a specific product or service. In the context of financial/crypto markets, it is the value buyers offer for an asset, such as a commodity, security or cryptocurrency.

The asking price is the minimum price that an individual would be willing to sell their asset, or the minimum amount that they want to receive in return for the unit(s) they are parting with.

Here you can see all of your open orders. To cancel an open order, just click the ‘X’ symbol next to it.

Limit order gives you the power to set a specific price at which you would like to buy or sell the desired amount of cryptocurrency.

A market order is an order type that enables you to buy or sell at the best available market price.

A Stop Loss Limit order is designed to limit your loss on a cryptocurrency position. A Stop Loss Limit order can be placed to buy or sell a specific cryptocurrency at your entered price (a limit order) once that cryptocurrency reaches a certain price.

A take profit limit order is an order put in place by traders to maximize their profits and protect their profits on positions. A take profit limit order allows you (a trader) to set your custom made Buy or Sell order. You have to set two prices - the Trigger Price and the buy/sell Price.