On the 4th of November, American citizens across the U.S. voted for their next president. By the 5th it was clear that Donald Trump would take victory. Within 24 hours, Bitcoin’s value had soared by over $8,000. Since then, Bitcoin has hit a new all-time high (ATH) of over $93,000, nearing expert forecasts that Bitcoin’s value will reach $100,000 before the year is out. But why has Donald Trump’s victory influenced Bitcoin’s value? Will this positive trend spill over to the wider crypto market and influence other cryptocurrencies? Is this a good time to invest in Bitcoin? Let’s explore.

Why has Bitcoin’s value increased?

Most analysts point to Donald Trump’s election victory as the reason behind Bitcoin’s recent surge in value. At the Bitcoin Conference 2024, which took place from the 25th to the 27th of July, Trump gave a keynote speech in which he hailed Bitcoin and claimed that he would make the United States the “crypto capital of the planet” if he was re-elected.

He went on to make many more pro-crypto statements, promising to fire Gary Gensler, Chairman of the Securities and Exchange Commission (SEC), on his first day in office; set up a Bitcoin Advisory Council to provide expert guidance on digital asset policy; and create a “national Bitcoin stockpile” of all the Bitcoin the U.S. currently holds in the form of seized assets.

However, experts have since questioned the probability of Trump realizing these plans, stating that many of his so-called “promises” go against the principles of crypto, and demonstrate his lack of knowledge on the subject. Whether his plans are possible or not, his highly pro-crypto rhetoric and confidence in Bitcoin especially, has led to hugely positive market sentiment. As the leader of arguably the most influential nation in the world, his stance on crypto has naturally incited confidence in the crypto community, and boosted adoption of Bitcoin in particular.

Will this affect other altcoins?

In short, yes. If we look back over Bitcoin’s price history, Bitcoin's price movements have always influenced altcoin values due to its dominant market position. As Bitcoin's value increases, it often attracts investor attention to the cryptocurrency space as a whole, which leads to increased interest and investment in altcoins. The recent surge in Bitcoin’s value (to over $93,000 on 13th of November 2024) has had a significant impact on the wider crypto market, and altcoins in particular. For example, Solana’s value (SOL) has increased by over 40% since the announcement of Donald Trump’s victory, and ether (ETH) by around 30%.

Is this a good time to invest in Bitcoin?

The recent surge in Bitcoin’s value is hard to ignore. Impressive new ATHs have captured the attention of investors considering entering the cryptocurrency market, with the reelection of Donald Trump being a pivotal factor in this increased interest. Analysts have also described this as the beginning of a new bull market for cryptocurrencies, projecting that Bitcoin could reach $100,000 by the end of the year.

However, investors in cryptocurrencies should always exercise caution. Despite the optimistic outlook and recent surge in values, Bitcoin and the crypto market remain volatile. Analysts from Glassnode have identified warning signs that the current rally may face a pullback, noting that Bitcoin is in a new price-discovery phase, which historically lasts around 22 days before a correction. As such, while the current market conditions may seem favorable, it's essential to approach Bitcoin investment with a well-considered strategy and acknowledge both the potential for gains and the associated risks.

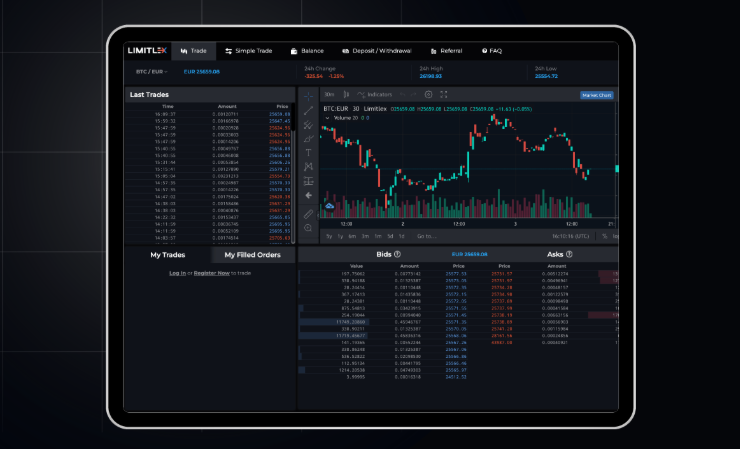

For more information on investing in crypto, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.