Before you embark on your cryptocurrency trading journey, it's of utmost importance to take the time to define your risk tolerance level and set clear objectives. This involves assessing how much capital you are genuinely comfortable risking in the volatile cryptocurrency market and determining the desired returns you aim to achieve.

By defining your risk tolerance level, you are establishing the boundaries within which you are willing to take on potential losses. This step requires self-reflection and an understanding of your financial situation, investment experience, and personal comfort with risk. Some individuals may be more conservative and prefer to minimize risk by allocating a smaller portion of their capital to cryptocurrency trading. Others may have a higher risk appetite and be willing to allocate a larger portion. You must choose which type of trader you are. It's crucial to be honest with yourself about your risk tolerance to ensure that you're not exposing yourself to financial stress or jeopardizing your long-term financial goals.

In addition to determining your risk tolerance, setting clear objectives is equally essential. By establishing realistic expectations for your crypto trading activities, you can avoid getting swept away by the allure of overnight riches or succumbing to irrational decision-making. Your objectives may include specific financial goals, such as achieving a certain percentage of return on investment or generating a consistent income from trading. You may also set non-financial goals, such as learning about the cryptocurrency market, gaining trading experience, or developing a long-term investment strategy.

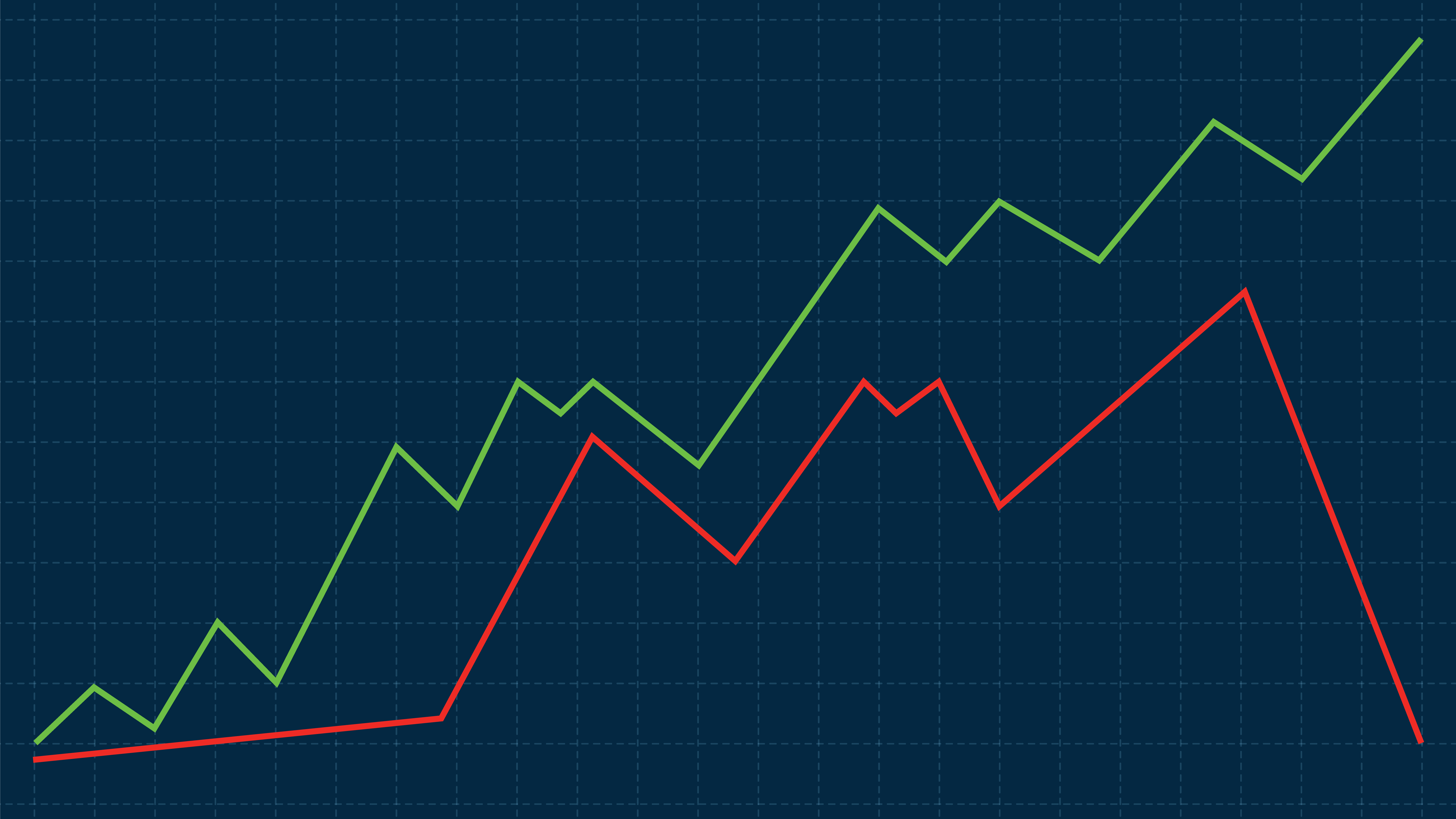

Doing this provides you with a roadmap and a benchmark against which you can measure your progress and make informed decisions. It helps you stay focused and avoid impulsive actions driven by short-term market fluctuations. By aligning your risk tolerance and objectives, you can strike a balance that aligns with your personal circumstances and enables you to make calculated, rational decisions in the face of market uncertainties. By evaluating these factors, you will be better equipped to navigate the market's ups and downs with a level-headed approach. This disciplined mindset will enable you to manage your risk effectively, and increase your chances of long-term success in the exciting world of cryptocurrency trading.