Just like traditional investment portfolios containing assets such as stocks, bonds, commodities and real estate, a crypto portfolio must be equally as diversified and balanced. The main reason behind building a balanced portfolio is to mitigate risk. A portfolio that has invested most of its capital in just one or two cryptocurrencies ties the investment to the success or failure of these assets; in other words, the eggs are all in one basket.

Given the volatility of the crypto market, the likelihood of losses can be high. Even diversification is not a surefire guarantee of a winning portfolio, but it does set investors up for a much better chance of positive returns. In this article, we take a look at some key tips and strategies to help build a balanced crypto portfolio and why it’s so important to do so.

What does a balanced crypto portfolio look like?

Achieving a balanced crypto portfolio involves several strategies, each aimed at mitigating risk and maximizing potential profits. One approach is to invest in market leaders, such as Bitcoin or Ether, and allocate funds among the top cryptocurrencies by market cap, typically the top 10 or 20. This method offers relative stability compared to less popular coins, though given the nature of the crypto market, volatility is still an important factor to bear in mind.

The primary advantage of a balanced crypto portfolio lies in risk reduction so that no single cryptocurrency's success or failure dictates its overall performance. Diversification also increases the likelihood of benefiting from the positive performance of market outliers, which could include meme coins, such as Dogecoin, and other lesser-known altcoins. However, managing such a portfolio demands time and effort and requires a lot of research and follow-up. It’s also important to review your portfolio every now and again, especially when there is a major shift in the market, and reshuffling asset allocation if necessary.

Diversification by industry

Diversifying a crypto portfolio by industry involves strategically investing in cryptocurrencies across various sectors within the crypto market. This method requires an in-depth understanding of different crypto projects but can offer significant rewards when done effectively. By spreading investments across different industries or sectors, such as decentralized finance (DeFi), borrowing/lending platforms, artificial intelligence (AI), non-fungible tokens (NFTs), and gaming, investors can mitigate the risk associated with sector-specific downturns. What’s more, by learning how to identify promising projects that could capture a significant market share within their respective sectors early on, investors can potentially realize substantial long-term returns.

Bitcoin exchange-traded funds (ETFs)

More traditional investors looking to include cryptocurrencies in their portfolio may choose to invest in a Bitcoin exchange-traded fund. As of January 2024, 11 Bitcoin exchange-traded funds are on the market. The advantage of including one or more of these funds in a balanced portfolio is the detachment from direct exposure to the volatility of the crypto market. Investors gain exposure to Bitcoin’s price movements without purchasing the cryptocurrency outright. This option can be particularly attractive to investors who are new to crypto. Some Bitcoin ETFs include stocks as well as Bitcoin futures, which helps create an overall balanced portfolio.

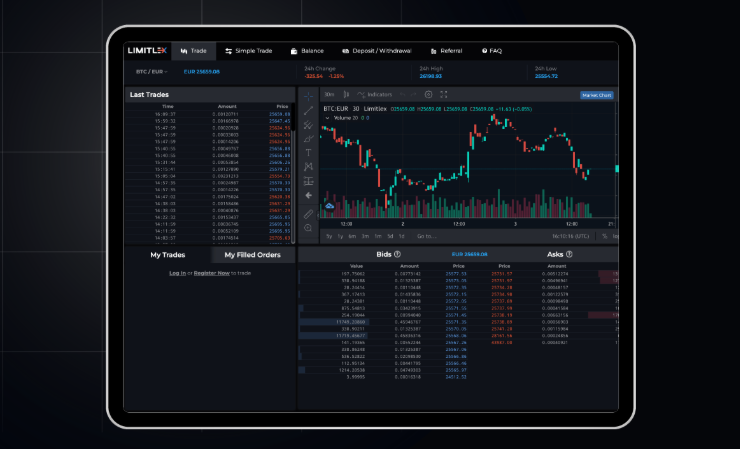

To learn more and start trading with Limitlex, visit limitlex.com.