As of 5th of March 2024, Bitcoin is nearing its all-time-high of $68,991.85 USD. The increased demand for Bitcoin towards the end of February 2024 led to a surge in value, understood to be the result of several contributing factors, including the recent approval of spot Bitcoin exchange-traded funds (ETFs) in the United States, which has helped consolidate Bitcoin as a mainstream investment. The forthcoming Bitcoin halving event, due in April, is also believed to be driving the recent increased demand for the most popular cryptocurrency on the market. The supply of Bitcoin will evidently diminish following the halving event, meaning that less Bitcoin will enter the market and be available for trading.

So, how cautious should traders be about the increased demand for Bitcoin?

To what can the recent increased demand for Bitcoin be attributed?

The recent approval of eleven Bitcoin ETFs in the United States has had a significant impact on Bitcoin's price. The decision helped create a more accessible and less volatile route for investing in Bitcoin, allowing more mainstream investors and traders —well versed in stocks rather than crypto— to gain a share of the market. Since early January, these ETFs have not only seen unprecedented inflows of investment, they also emphasize Bitcoin's growing legitimacy and appeal as part of a diverse portfolio. The increase in institutional interest that has followed has contributed significantly to the surge in demand. Bitcoin is now widely recognized as a store of value, attracting both institutional and retail investors who are interested in holding the digital asset.

Contributing factors leading to a lower supply

The increased demand for Bitcoin has caused its price to soar, inviting even more attention onto the cryptocurrency market, and onto Bitcoin in particular. The impending halving event in April has further intensified anticipation. Bitcoin halving events, also known as “halvenings” occur every four years and essentially “halve” the reward miners receive for processing Bitcoin transactions. In April 2024, the reward is expected to be cut from 6.25 bitcoins to 3.125. The reduction in supply, coupled with the heightened demand from ETFs, is set to create the perfect storm for a potential scarcity of Bitcoin, which may drive prices even higher.

What can traders expect from Bitcoin in 2024?

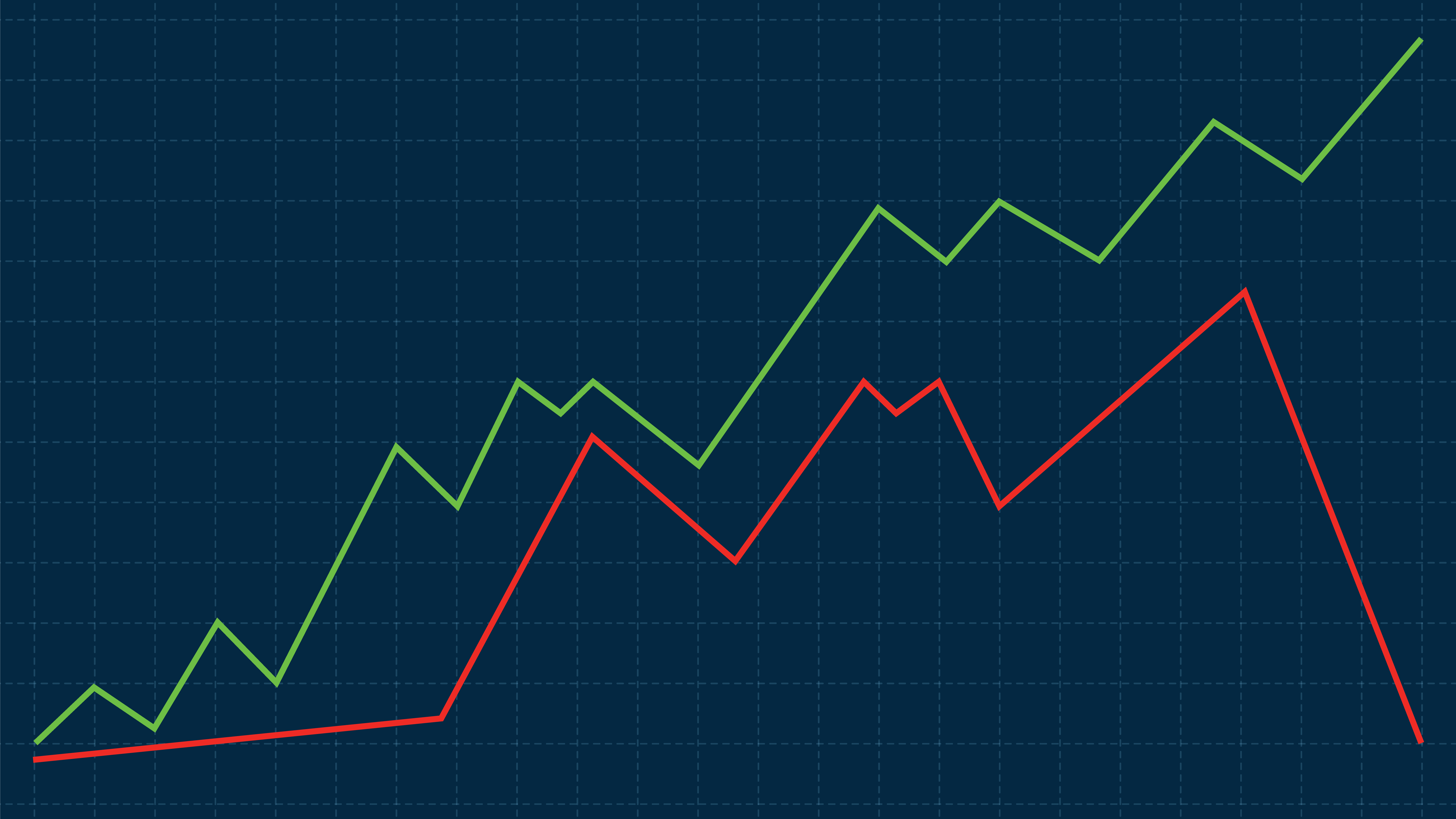

A recent report suggests that Bitcoin will reach a new record of $88,000 (€82,000) in 2024, before settling around $77,000 by the end of the year. The positive trajectory is supported by the ongoing demand from institutional investors, driven by the spot Bitcoin ETFs and the upcoming halving event. With Bitcoin's finite supply and increasing mainstream acceptance, many crypto natives, experts and analysts believe that the popular cryptocurrency is poised to increase in value even further in the coming months. However, the increased institutional investment in Bitcoin highlights the importance for traders to follow their moves and market sentiment closely. Major sales or withdrawals have the power to significantly shift Bitcoin’s value, potentially causing a ripple effect across the cryptocurrency market. Traders are advised to watch market trends closely and always bear the volatility of the cryptocurrency market.

For more information or to start trading, visit www.limitlex.com.