At the time of writing, Bitcoin hit a historic price and new all-time high of $99,571 on November 22, 2024, just $429 off a value of $100,000, a monumental milestone in the history of cryptocurrency. Bitcoin’s value has been rising since the 5th of November, the day following the U.S. presidential election when a Republican win was imminent. Donald Trump’s victory has boosted confidence regarding potential regulatory changes that will make the U.S. a much more favorable environment for owning and using crypto, and Bitcoin in particular.

While investors watch the market closely as Bitcoin's price fluctuates, one takeaway is certain: Bitcoin’s growing mainstream acceptance is palpable. Some experts have even predicted that breaching the $100,000 milestone could trigger a new wave of retail and institutional investment, fueling even larger flows into the crypto market.

Join us as we take a look back over Bitcoin’s recent price history to identify the triggers and forecasts lighting up the crypto market.

Trump backs Bitcoin

Despite Donald Trump’s historic criticism and skepticism surrounding Bitcoin and cryptocurrency, 2024 is the year he saw the light. The United States’ current President elect is pro-crypto, which will have huge ramifications for the crypto industry in the U.S. should he come through on the promises he made earlier this year. For example, at the Bitcoin Conference 2024, Trump listed several initiatives he would bring into effect upon taking office. These included plans to reduce regulatory red tape for crypto startups, introduce clear and favorable guidelines for crypto taxation, and create a national blockchain task force to explore the integration of decentralized technologies across government and private sectors.

The recent surge in Bitcoin’s value

Bitcoin’s value surged by around 45% in November 2024 due to several important factors. As discussed above, the re-election of President Donald Trump on the 5th of November 2024 played a significant role in driving up market sentiment and subsequently, Bitcoin’s value, thanks to his pro-crypto rhetoric and stance.

This increased confidence has led to significant institutional investment, which has undoubtedly had an impact on Bitcoin’s price surge. Global economic uncertainty and the ongoing devaluation of FIAT currencies have further strengthened Bitcoin's appeal as a hedge against inflation. Retail investors have also joined the rally, spurred by optimistic price predictions and the growing anticipation of Bitcoin breaking the $100,000 barrier.

Should traders beware of a price correction?

While some experts still predict Bitcoin to reach the $100,000 mark before the end of the year, traders and investors should beware of possible price corrections. Some analysts have cautioned that if Bitcoin fails to break through the $100,000 threshold, it could experience a pullback to around $85,600.

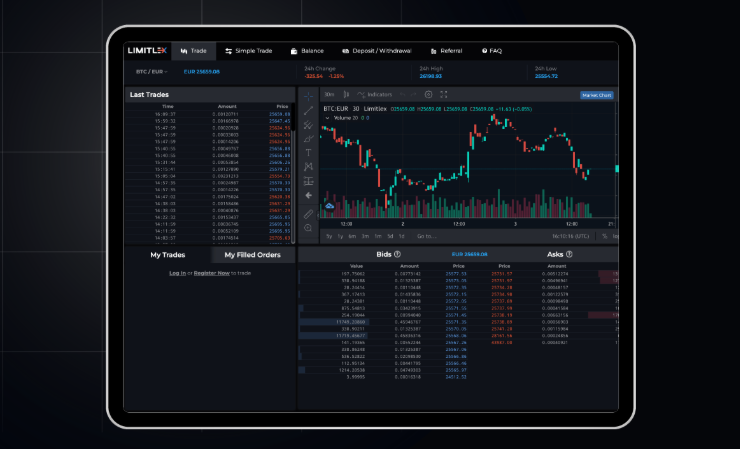

At the time of writing, Bitcoin’s price fell by over 5.6% in the past 24 hours, representing a drop of almost $5,000, highlighting the market’s high volatility, despite the recent upward trend. This example underscores the importance of monitoring market dynamics and setting appropriate risk management strategies such as stop loss orders, or Limitlex’s Sell All order.

For more information on investing in crypto, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.