There are many different strategies used by traders to capitalize on market fluctuations: the one we are looking at today is known as ladder trading. Ladder trading is a strategy that involves placing multiple buy or sell orders at different price levels. It uses what is known as a price ladder, a visual, easy-to-read tool that offers real-time information on changes in market prices, allowing traders to see how the market is evolving and act quickly and efficiently, especially when trading multiple crypto assets.

When did traders start using price ladders?

Price ladders have been used by traders since the dawn of electronic trading. The transition from open outcry trading (think the New York Stock Exchange) to digital platforms in the early 2000s marked a pivotal shift in styles and strategies. The introduction of tools such as MD Trader from Trading Technologies was a game-changer for order execution as it helped traders visualize price levels in ladder format.

While it was initially designed for professional traders, it was subsequently rolled out and made accessible to retail traders. Today, it is widely used by traders operating in the forex and derivatives markets. Price ladders have added a huge amount of precision to many traders’ work, helping with order placement and exit strategies.

How does ladder trading work?

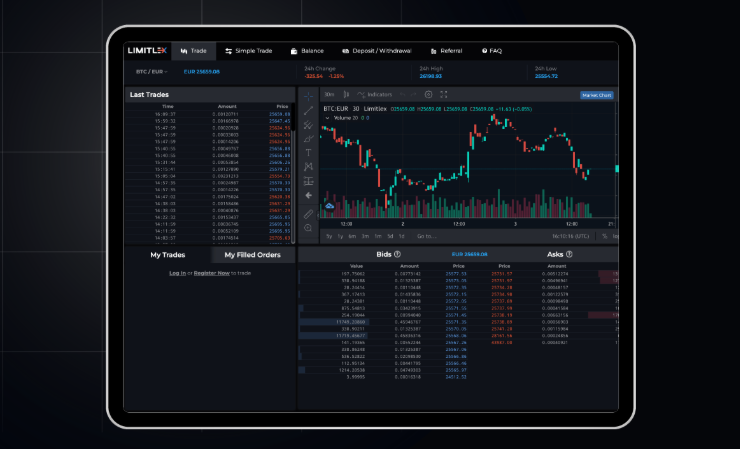

Ladder trading works by showing traders the price ladder display, including bid and ask prices in a vertical format, as well as market depth. Market depth refers to the visible representation of the number of buy (bid) and sell (ask) orders at various price levels in a market. Another feature, last known quantity (LTQ), shows traders how much of an asset (such as Bitcoin or Solana) was last traded at that particular price.

The greatest advantage of ladder trading is speed, as it allows traders to quickly place, modify, or cancel orders directly on the ladder by clicking at specific price levels. It is a particularly useful tool for traders who employ scalping or intraday trading strategies, as it allows them to react swiftly to price changes and manage multiple orders without having to manually fill out order forms. In short, a price ladder serves as an “interactive order book” that allows for point-and-click trades.

Another term for ladder trading…

Ladder trading is sometimes referred to as depth of market (DOM) trading, a strategy often adopted by day traders. By way of comparison, traders might use a candlestick chart to see how the market has performed over previous days, weeks, or months. A price ladder, however, displays what is happening right now. They are often used in conjunction and can help traders decipher patterns and gain a more in-depth understanding of the volatile crypto market (or the futures, stocks, and forex markets, where traders also employ strategies using price ladders and DOM trading).

Other common trading strategies for the crypto market

Crypto traders sometimes employ a strategy known as scalping (mentioned above) to help capitalize on the market’s volatility. Scalpers profit from small price changes and often use tools such as price ladders to define price entry and exit points. For example, during periods of high activity, traders might scalp Bitcoin, gaining off its frequent $100-$200 swings within minutes. But, this method requires a robust and precise trading platform that offers low transaction fees in order to maximize profits.

Another popular trading strategy is swing trading, which traders often use with assets such as Ethereum and Solana. The strategy involves holding positions for days or weeks to exploit broader price trends. Swing traders often rely on technical market analysis, such as identifying support and resistance levels to time their trades effectively. While both strategies can be very lucrative, they require practice, discipline, and a solid risk management plan to help navigate the market's dramatic peaks and troughs.

Read our FAQs for more on Limitlex’s tools and order options. For more information on trading crypto, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.