The recent approval of 11 Bitcoin spot ETFs (Exchange Traded Funds) by the U.S. Securities and Exchange Commission (SEC) marks a significant milestone in the evolution of the cryptocurrency market, prompting reflections on its potential implications for investors and traders, particularly in the United States. The new funds come from institutions such as BlackRock, Fidelity, Bitwise, Franklin Templeton, and Invesco.

This pivotal move could impact traders' trading strategies, incline them to align with evolving market dynamics, and potentially move away from trading Bitcoin itself to trading Bitcoin spot ETFs through exchanges such as Nasdaq, NYSE, and the CBOE. This greater accessibility is believed to make investing and trading in Bitcoin easier without owning the crypto or being exposed to the market’s volatility. This could inspire stock exchange traders to incorporate these funds into their portfolios.

This article closely examines the recent Bitcoin spot ETF approval and what it might mean for traders inside and outside the United States.

A pivotal move by the SEC

The SEC’s decision signals a potentially transformative change in the perception and trading dynamics of cryptocurrencies. Leaders at the SEC have long been crypto skeptics, consistently cautioning the public about the risks involved in investing in and trading on predominantly unregulated markets. In fact, in reality, their stance has shifted very little. Following notification of the approval, SEC chair Gary Gensler clarified that “while we approved the listing and trading of certain spot bitcoin (ETFs) today, we did not approve or endorse bitcoin”.

What we might expect from the market

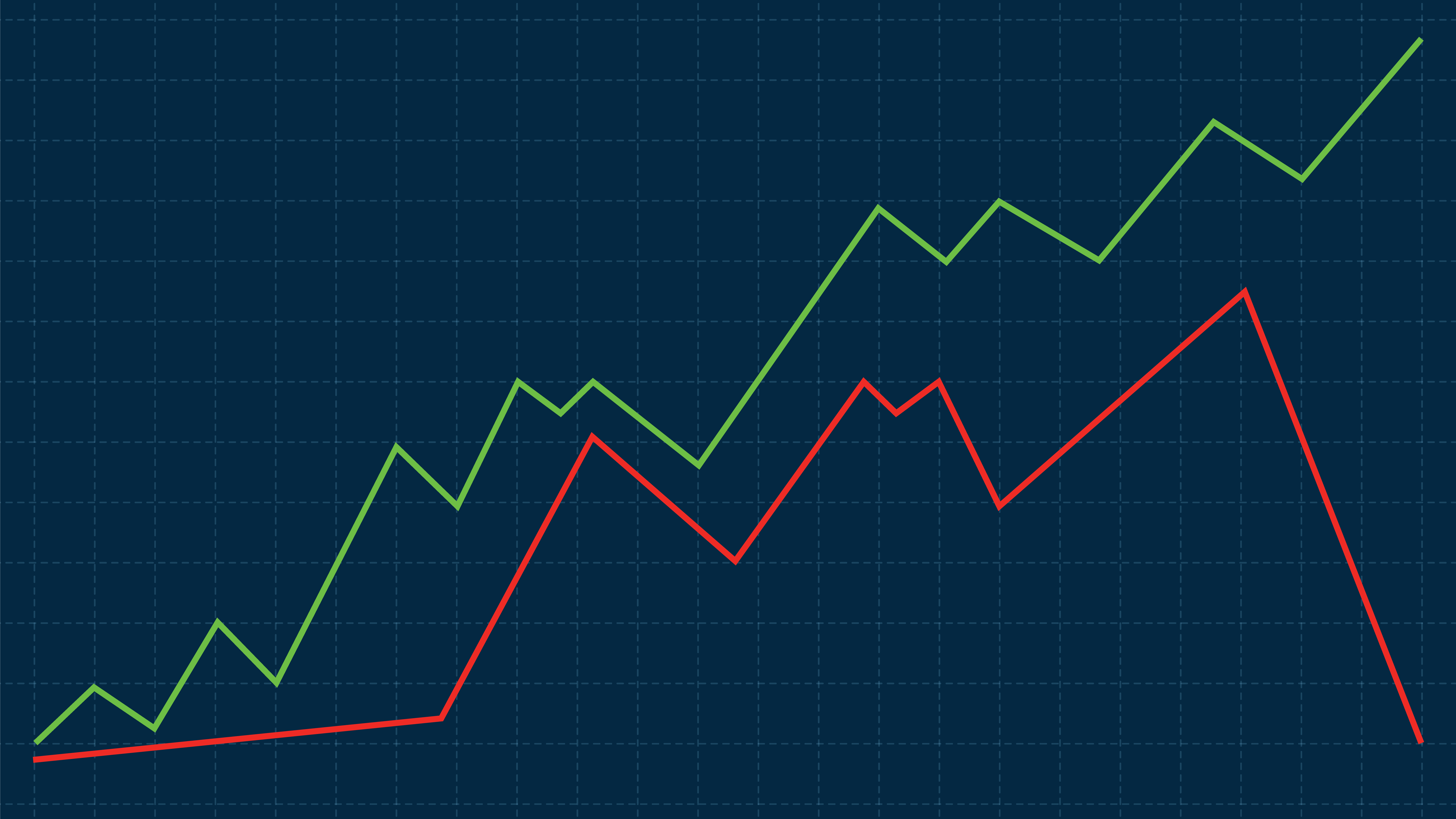

Similar to the reaction witnessed with the introduction of Bitcoin futures in 2017, the approval of Bitcoin spot ETFs raises expectations of substantial market movements. In the days following the approval, just under $1 billion flowed into the new ETF market, most of which went to BlackRock (which saw an influx of $723 million). However, the excitement over these first few trading days does not guarantee long-term value. In the weeks and months following the approval, traders will closely monitor the ETFs’ value, potential Bitcoin price shifts, and the broader impact on the cryptocurrency market.

The development is poised to profoundly impact U.S. traders and investors and increase distribution within the United States, enhancing the credibility of cryptocurrency as a legitimate asset class. The availability of a regulated ETF eliminates the complexities of cryptocurrency storage, providing a more straightforward avenue for investors to gain exposure to Bitcoin without navigating the intricacies of digital wallet management. Overall, the SEC's approval is seen as a watershed event on the road toward mainstream acceptance and integration of Bitcoin into traditional investment avenues in the United States and beyond.

Considerations for European investors

The SEC's approval of Bitcoin spot ETFs is anticipated to have a limited direct impact on European investors, who already have access to cryptocurrency ETFs. However, introducing trading options on these ETFs is expected to create new opportunities for global options traders. Despite potential constraints on direct investment in the approved ETFs for European investors due to UCITS compliance requirements, the secondary effects could be substantial.

The increased volume and liquidity in the new US-listed ETFs are poised to provide European investors with a more viable alternative than existing cryptocurrency ETFs in European markets, which often suffer from liquidity issues. Even if European investors do not directly participate in the newly approved ETFs, the anticipated ripple effects of heightened liquidity and establishing a robust options market present a fresh avenue for strategizing and potentially profiting from Bitcoin's price movements.

The SEC's approval of Bitcoin spot ETFs introduces a new chapter in the cryptocurrency market, influencing both US and European traders. However, traders must remain vigilant, adapting their strategies to navigate the evolving landscape and capitalize on potential opportunities this milestone development presents.

To learn more and start trading with Limitlex, visit limitlex.com.