The eight spot ether (ETH) ETFs launched on the 23rd of July 2024 have now been trading for a week. After a rule change was approved (so-called “19b-4 forms”) back in March, allowing the listing and trading of exchange-traded funds, Ethereum became the second cryptocurrency project of the year to launch crypto-based ETFs into the mainstream investment sphere. New funds are being introduced by traditional fund managers like BlackRock and Fidelity, alongside cryptocurrency-focused firms such as Grayscale, in another significant move towards the integration of digital assets into mainstream finance. Proponents of the Ethereum blockchain and protocol hope the launches will help raise awareness among the wider investor community about the tech benefits of Ethereum, such as processing financial transactions, executing smart contracts, and storing data for third-party applications.

In this article we take a closer look at what Ethereum and ether are, why the ether (ETH) ETF launches are so important, how the market reacted, and how the wider crypto ecosystem might be impacted in the future.

What is Ethereum?

Ethereum is a global, decentralized platform that extends beyond traditional cryptocurrency functions to facilitate a wide range of applications and services. At its core is a blockchain network —a decentralized and distributed public ledger— which allows participants to verify and record transactions. Unlike centralized systems, Ethereum operates without a single governing entity, and every participant holds a complete copy of the ledger. This ensures transparency and security, as transactions are safeguarded using cryptography.

Ether is the native token of the Ethereum network and facilitates transactions in a similar way to Bitcoin. However, Ethereum's unique capability lies in its support for decentralized applications (dApps) and smart contracts, which enable users to build and run software directly on its blockchain. This functionality allows Ethereum to power a wide range of applications spanning financial services to interactive games, making it a versatile and now irreplaceable part of the digital economy.

Why are ETH ETFs so important?

The launch of the Ether ETFs represents a significant development for mainstream investors, providing them with a straightforward way to gain exposure to Ethereum without directly owning the cryptocurrency. These funds function like traditional stocks but are composed of baskets of cryptocurrencies designed to mirror Ethereum's price fluctuations. This structure allows investors to benefit from Ethereum's market movements while avoiding the technical complexities of managing ETH tokens, crypto exchanges and wallets directly.

The regulatory framework governing ETFs also adds a layer of security and confidence for traditional investors who may be wary of the risks associated with direct cryptocurrency investments. Listing ETH ETFs on established stock exchanges ensures adherence to well-known regulatory standards, which in turn boosts investor confidence and encourages broader market participation. This increased participation, in turn, helps enhance liquidity and stabilize Ethereum's price by reducing volatility.

The immediate aftermath

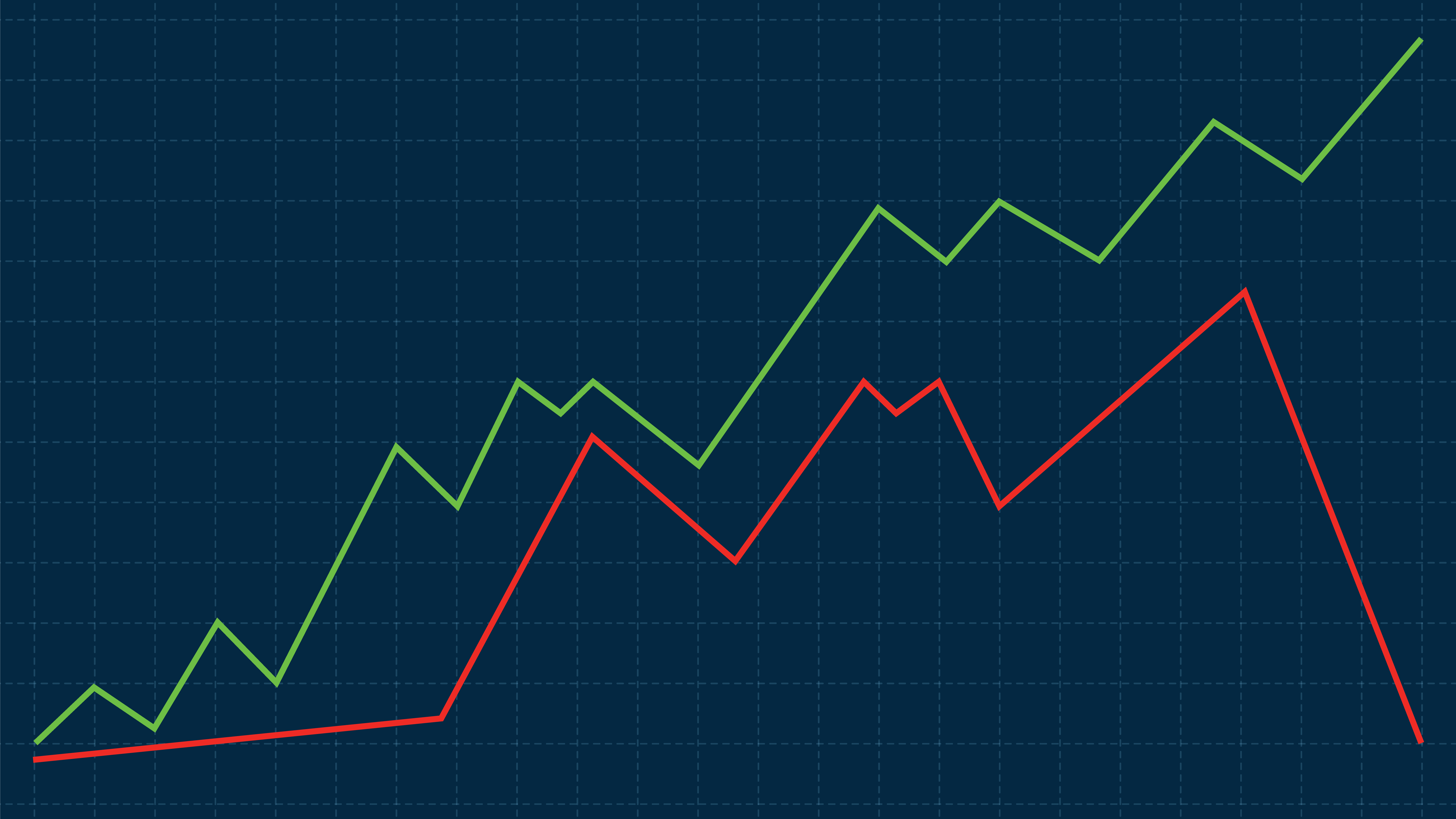

The first day of trading following the ether ETF launch was a hive of activity, seeing a total inflow of $106.6 million. But after this initial success, the ETFs faced a challenging first week. Much like Bitcoin’s 14% drop following the spot bitcoin ETF release, ether’s value dropped 7.82% in the first three days after the spot ETF launch. Some of this loss was due to the $1 billion-plus that exited Grayscale’s converted fund (ETHE), while other ETFs also struggled to maintain positive inflows. Despite these challenging early days, recent reports show that the ETFs have accumulated an impressive $2.2 billion in inflows, while ETH exchange-traded products (ETPs) have experienced growth of 542%. These numbers were helped by strong performances from Grayscale’s ETF, the Ethereum Mini Trust ETH (ETH), which recorded a net inflow of $44.9 million on the 26th of July.

The wider crypto ecosystem

Like their bitcoin counterparts, the eight spot ether ETFs have no doubt impacted the wider crypto ecosystem. By opening the door to more hesitant, mainstream investors, both launches invite greater interest, investigation, and participation not only in bitcoin and ether —and their respective protocols— but also in the wider potential of crypto and blockchain. The acceptance of ether ETFs (both spot and futures) indicates a growing maturity and legitimacy of the crypto market and increasing trust from both regulators and investors.

Over the past few weeks, Bitcoin (BTC) has also recently experienced significant inflows totaling $3.6 billion and reaching a historic YTD high of $19 billion, which also highlights growing investor confidence and interest. Analysts from CoinShares attribute this surge to speculation about the upcoming US elections. As with most assets, the medium- and long-term impact of both bitcoin and ether ETFs depends largely on the political climate and the potential for Bitcoin to be viewed as a strategic reserve asset.

Limitlex strongly encourages traders and investors to properly assess the viability and longevity of all crypto projects and fully analyze each investment choice.

To learn more and start trading with Limitlex, visit limitlex.com.