As Bitcoin (BTC) hits new lows, as the time of writing* now down year-to-date, a bearish sentiment is taking hold across the crypto market. But the crypto OG isn’t the only asset to suffer. The altcoin market has also seen mixed activity, and Ethereum and Solana drop below $3,000 (ETH) and $130 (SOL) respectively. Overall, the total crypto market capitalization has dropped 27% from October’s highs of $4.2 trillion to around $3 trillion. As many traders appear to be locking in profits after recent gains. A mix of nerves and unwinding positions seems to be weighing on the market, with big ETF outflows, shifting expectations for Fed rate cuts and a burst of long-liquidations adding extra pressure. Even large-cap altcoins are feeling the squeeze, while long-term holders quietly scoop up coins in the background.

In this article, we explore what’s driving the latest pullback, how Bitcoin’s fall is setting the tone and what these moves might mean for the altcoin landscape as the market searches for its footing.

Macro conditions shaping the market

It’s no secret that crypto wavers under looming uncertainty, and there has been plenty of it lately. As expectations for a quick Fed rate cut fade, investors have pulled back and moved toward safer ground. And in typical fashion, crypto is feeling the ripple effects more sharply than most. Recent U.S. economic data hasn’t offered much comfort either. Softer readings have raised fresh questions about the wider outlook, giving traders yet another reason to tread carefully. And after a strong run earlier in the year, the mood has flipped quickly.

Long-position liquidations have surged, wiping out months of built-up leverage in a matter of days. On top of that, ETFs have flipped from steady buyers to notable sellers, with U.S. spot Bitcoin ETFs seeing some of their biggest withdrawals to date. One day alone saw nearly $870 million leave the products, while BlackRock’s flagship fund recorded a single-day outflow of over $520 million, its largest since launch. These sharp reversals in ETF flows have added meaningful pressure to prices and sentiment, amplifying the market’s already uneasy mood.

What does Bitcoin’s slide signal?

Bitcoin's fall below $90,000 has caught everyone's attention, and not just because it's the lowest it's been since the start of the year. With BTC down this year, traders are keeping a close eye on the price to see if the key support levels will hold. Analysts have highlighted a few areas to watch, including the $90k region linked to the average ETF entry price, and deeper levels near $75k and $70k that line up with past cycle patterns. These zones have tended to be turning points in the past, which is why they're so important as the downtrend develops.

On the other hand, the on-chain picture tells a different story. Investors are still buying up coins for the long-term, and whale wallets have started to invest again after weeks of waiting. It's a situation that often arises toward the end of a market correction, where retailers sell off, pushing prices down, while investors with deeper pockets use the weakness to build their positions. Only time will tell if this is a sign of things to come, but it seems that Bitcoin's fall is about more than just short-term sentiment.

Altcoins also feeling the strain

Altcoins have been moving in a similar way to Bitcoin, with many struggling to keep up as traders move toward safer assets. Ethereum dipping below $3,000 and Solana falling under $130 have become important signs of the wider weakness, especially as both continue to make lower lows despite brief signs of stabilization. Even projects that seemed to be holding up earlier in the year are now struggling, as changing macro expectations and falling liquidity are pushing traders toward safer, more established assets.

But not every part of the altcoin market is responding in the same way. Some assets, like Hyperliquid, have stayed fairly stable, which suggests that there are still some pockets of resilience even as things turn more volatile in other areas. Meanwhile, outflows from ETFs and retail selling have put pressure on the majors, creating an uneven playing field where performance varies more than usual. Whether this gap gets bigger or smaller will depend on how quickly confidence returns, and whether Bitcoin can get back on track long enough for the rest of the market to recover.

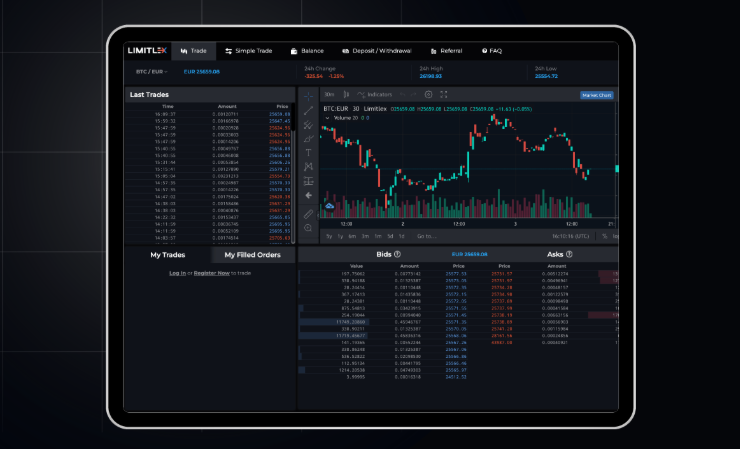

For more insights and reflections on crypto trading, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.

*This content is accurate at time of writing. Please check www.limitlex.com for today’s market movements.