For many, crypto day trading represents the ultimate financial dream: growing funds from a market whose movements unfold in hours instead of days. The idea of earning a living from the volatility of Bitcoin, Ethereum, and altcoins is undeniably appealing. With 24/7 markets, global access, and huge price swings, crypto seems like the perfect playground for traders with sharp instincts and fast reactions. But is it possible to make a living from crypto day trading? Well, yes, but it is far from easy. Day trading is a discipline that blends strategy, technical analysis, risk management and emotional control. For every trader celebrating profits, there’s another struggling to manage losses and control impulsive decisions. Day trading success tends to depend on your experience, mindset and the tools you use. But the right platform can help give you an edge in one of the most exciting markets of our time.

In this article, we explore what it really takes to turn crypto day trading into a sustainable income stream, and how Limitlex can give you the precision, control and tools to thrive in this fast-paced environment.

The potential and pitfalls of crypto day trading

Crypto day trading can be exhilarating. Fortunes can be made or lost in a matter of hours thanks to the crypto market’s volatility, which is what makes it so enticing. It allows traders to see dramatic price swings as opportunities for profit. Bitcoin might surge (or drop) hundreds of dollars within minutes, while altcoins can double (or halve) in a single trading session. The potential for outsized gains attracts ambitious traders looking to turn skill and timing into a consistent income stream.

Yet this enticing environment is exactly what could cause traders’ falldown, exposing inexperience and a lack of emotional control. Many beginners underestimate the impact of transaction fees, slippage, and poor risk management, while others fall into the psychological traps of fear and greed, overtrading in pursuit of quick profits. The crypto market never sleeps, and this 24/7 accessibility can lead to burnout and impulsive decisions if not managed carefully. Day trading success demands discipline, a well-tested strategy, and the experience to know when to act and when to observe from the sidelines.

Tips on how to succeed as a crypto day trader

If you're aiming to be a consistently profitable crypto day trader, you need more than just a few lucky trades. It's about having the right skills, staying disciplined, and constantly learning. Successful traders spend hours analyzing charts, identifying trends, and studying indicators such as volume, moving averages, and support or resistance levels. They also keep up to date on market news, token listings, and macroeconomic events that influence crypto sentiment. Every trade is planned, thereby informing traders of exactly when to buy or sell. In this world, knowledge really is power, and timing is everything.

But technical knowledge alone won’t make you successful. In reality, it’s the emotional side of trading that often separates winners from losers. Fear can cause you to sell too early, and greed might tempt you to hold on for too long. That’s why risk management is crucial: setting stop-loss and take-profit orders, never risking more than you can afford to lose, and maintaining a clear head even during high volatility. Ultimately, making a living from crypto day trading is about managing risk, controlling emotions, and sticking to a strategy that maximizes small, consistent gains over time.

How Limitlex supports successful crypto day trading

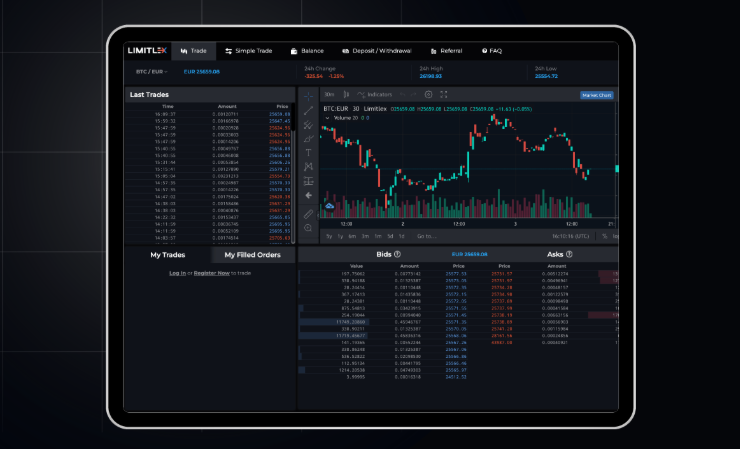

Even with experience and strategy on your side, trading results often come down to the quality of the tools at your disposal. Limitlex has been designed with both novice and professional traders in mind, and fitted with a suite of features that help simplify execution without sacrificing precision. Features like Market Orders allow you to react instantly to market opportunities, while Stop-Loss and Take-Profit Limits help automate risk management, ensuring you lock in profits or minimize losses even when you’re away from the screen.

The Basket Buy and Sell All tools make it easy to manage multiple assets in one go, saving valuable time during volatile trading sessions. New users can start quickly with a simple account setup and crypto deposit process, while real-time order notifications keep you informed the moment trades are filled. Transparent fee structures and smooth fund withdrawals give traders full control over their finances, leaving no room for ghost fees or unpleasant surprises. In the crypto market, every second counts, so Limitlex equips day traders with the speed, flexibility, and security they need to stay ahead.

For more insights and reflections on crypto trading, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.