In recent weeks, Bitcoin (BTC) has hit the headlines as it led a significant bull run that pushed the cryptocurrency to surge past its once-elusive milestone of $100,000. Bitcoin’s new all-time high is officially over $103,000, a figure many thought impossible in 2024. Despite a couple of corrections, the crypto market is still blazing. Naturally, attention has turned to the second-largest cryptocurrency by market cap, Ethereum (ETH). Traders and investors are now asking whether Ethereum, with its robust ecosystem and history of trailing Bitcoin’s rallies, could be set to follow suit and reach its own new all-time high in the coming weeks.

In this article, we take a closer look at the reasons behind Bitcoin’s new all-time high, Ethereum’s historical relationship with Bitcoin, and what current market sentiment might suggest about Ethereum’s future.

Bitcoin’s new all-time high

Bitcoin hit an impressive new all-time high on the 5th of December 2024 at $103,640.98. This historic milestone came after several weeks of bullish market behavior amidst which Bitcoin grew by around 50%. The surge can be attributed to several factors, including the election of President-elect Donald Trump, who, during his campaign rally, signaled he would instate a much more crypto-friendly environment in the U.S. by appointing pro-cryptocurrency figures such as Paul Atkins to lead the Securities and Exchange Commission (SEC).

Trump had also previously stated that should he be elected president, he would also set up a Bitcoin Advisory Council to provide expert guidance on digital asset policy, and create a “national Bitcoin stockpile” of all the Bitcoin the U.S. currently holds in the form of seized assets. Bitcoin’s inherent scarcity, the 2024 approval of 11 spot Bitcoin ETFs, and increasing global adoption, have also continued to drive demand and elevate its value.

Ethereum’s historical relationship with Bitcoin

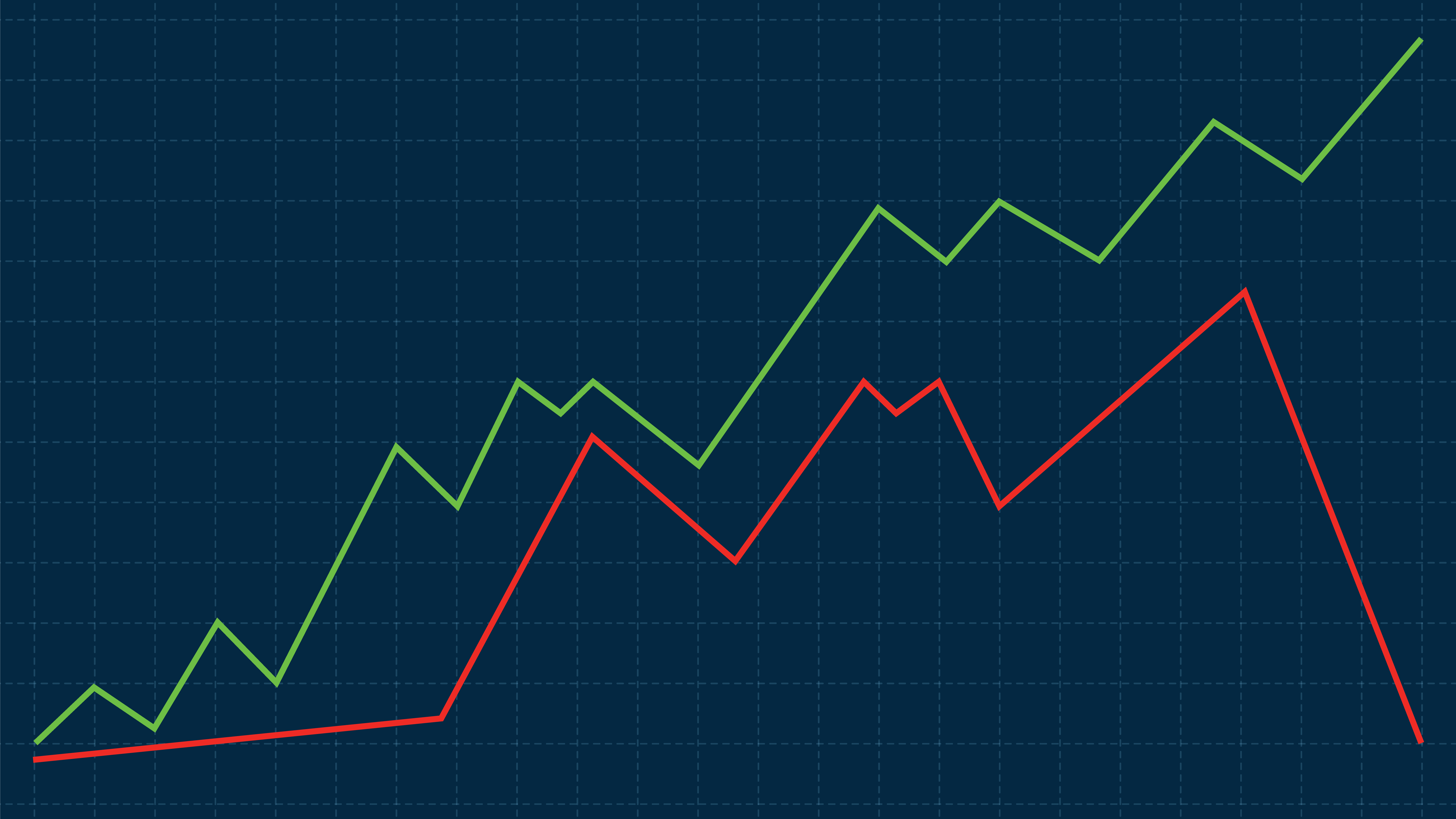

Historically, Ethereum’s price movements have closely reflected those of Bitcoin. Ethereum is often seen to be lagging behind the leading cryptocurrency during bull markets, nonetheless being pulled upwards by the immense influence of Bitcoin. Its dominance tends to drive overall sentiment, and liquidity flows across the crypto space, pumping capital into other large- and mid-cap cryptos. For instance, in the 2017 bull market, Bitcoin reached an all-time high of approximately $19,783 in December, shortly after which Ethereum peaked at $1,420 in January 2018.

But Ethereum is still a unique and standalone project. Ethereum has carved out a singular identity within the crypto space, thanks to its robust ecosystem, hosting decentralized finance (DeFi), non-fungible tokens (NFTs), and dApps, which could mean it decouples from Bitcoin’s influence and grasp over time. While Ethereum’s historical relationship with Bitcoin is still very much present, its development as both a financial asset and decentralized software platform could lead to more independent price behavior in the future.

Ethereum’s future: What can we tell from market sentiment?

Recent developments across the crypto space could indicate a bullish sentiment toward Ethereum (ETH). For example, Ether ETFs have experienced record inflows, with a single-day addition of $428.5 million, bringing total investments to over $1 billion since their launch in late July 2024. This surge reflects growing institutional interest, which is also likely to have been influenced by the promise of pro-crypto regulatory changes under the forthcoming presidency of Donald Trump.

Overall, the combination of increased institutional investment and positive trader sentiment suggests a favorable outlook for Ethereum's near-term performance. The likelihood of Ethereum hitting a new all-time high in the coming weeks is the subject of much speculation. Some forecasts suggest that Ethereum could reach new all-time highs, potentially exceeding $5,000. However, the market remains volatile, following a recent price drop of around 6%. These fluctuations underscore the importance for traders and investors to closely monitor markets and remain cautious, even when market sentiment is optimistic.

For more information on investing in crypto, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.