Bitcoin and cryptocurrency are two inextricably linked phenomena. As the first and most popular cryptocurrency in the crypto sphere and market, Bitcoin has paved the way for an alternative financial system to emerge: decentralized finance, or DeFi. Following the launch of Bitcoin and blockchain technology in 2009, countless other cryptocurrencies, including stablecoins and tokens, have been created, each with its own use case, governance structure, and underlying technologies, further expanding the possibilities of decentralized finance and digital asset ecosystems.

Cryptocurrency offers a host of benefits compared to traditional FIAT currencies, i.e. dollars, euros, yen, etc. The last 10 years have seen growing adoption of both cryptocurrencies and DeFi infrastructures, representing an important shift in how wealth and financial services are understood, managed, and accessed, leading to greater inclusivity, transparency, and efficiency.

In this article, we provide a detailed summary of Bitcoin and cryptocurrency, their origins, decentralized finance, and how they have and will continue to transform global financial systems.

Where did Bitcoin and cryptocurrency come from?

Bitcoin and cryptocurrency were invented in 2009 by Satoshi Nakamoto. Their real identity remains unknown, but is thought to be an individual or group, inspired to create an alternative currency and financial system following the 2008 financial crash caused by Wall Street bankers. Nakamoto published a seminal paper in 2008 titled Bitcoin: A Peer-to-Peer Electronic Cash System, outlining the idea of Bitcoin as “an electronic payment system that relies on cryptographic proof rather than trust.”

As part of this system, which would become known as decentralized finance, each transaction would be verified and recorded using cryptography on a blockchain, an unknown technology at the time, ensuring transparency and security. Fifteen years after its launch, Bitcoin has become the most widely traded cryptocurrency, with a market cap exceeding $1.13 trillion as of August 2024. In March 2024, Bitcoin's market cap surged to $1.4 trillion, surpassing that of silver.

What are the benefits of decentralized finance?

Decentralized finance, or DeFi, offers a range of benefits that challenge those of traditional financial systems, providing users with greater autonomy, control, transparency, and accessibility when managing their financial assets. To start with, DeFi is open access, meaning users do not need to create accounts or provide personal information to obtain a wallet and start accepting and moving funds, which offers greater privacy and inclusivity. It is also fast and flexible, allowing users to move assets freely without delays or high fees. What’s more, the transparency of DeFi means all transactions are visible on the blockchain, promoting greater trust and accountability in this alternative financial system.

DeFi offers users services that are more flexible and accessible than traditional banks, such as lending out their crypto to earn interest in real-time, obtaining instant loans without the need for paperwork, and trading assets directly with peers. DeFi also allows users to save for the future with potentially higher returns and engage in derivative trading, similar to stock options or futures, which has made crypto and DeFi particularly attractive to younger generations, such as Millennials and GenZ, disillusioned by financial crashes, recurrent recessions, devalued currencies, and mismanaged economies.

Can you pay for goods and services with cryptocurrency?

Yes! One of Bitcoin and cryptocurrency’s main functions is to pay for goods and services. Digital currencies offer a decentralized and secure means of transaction that bypasses traditional banking systems. Many merchants and businesses, both online and offline, now accept cryptocurrencies and stablecoins such as Bitcoin, Ethereum, Litecoin and USDT as direct forms of payment.

Other merchants and businesses choose to onboard a crypto payment gateway, such as ForumPay, which creates a seamless bridge between crypto consumers and merchants, in the same way, debit or credit card companies such as Visa or Mastercard send money from consumers’ bank accounts to the merchants’ business.

ForumPay’s solution is designed to enhance the utility and real-world applications of Bitcoin and cryptocurrency and is often much cheaper for merchants to accept crypto payments than debit or credit card payments, given the high commission rates charged by these companies, even on micro transactions.

Trading Bitcoin and cryptocurrency

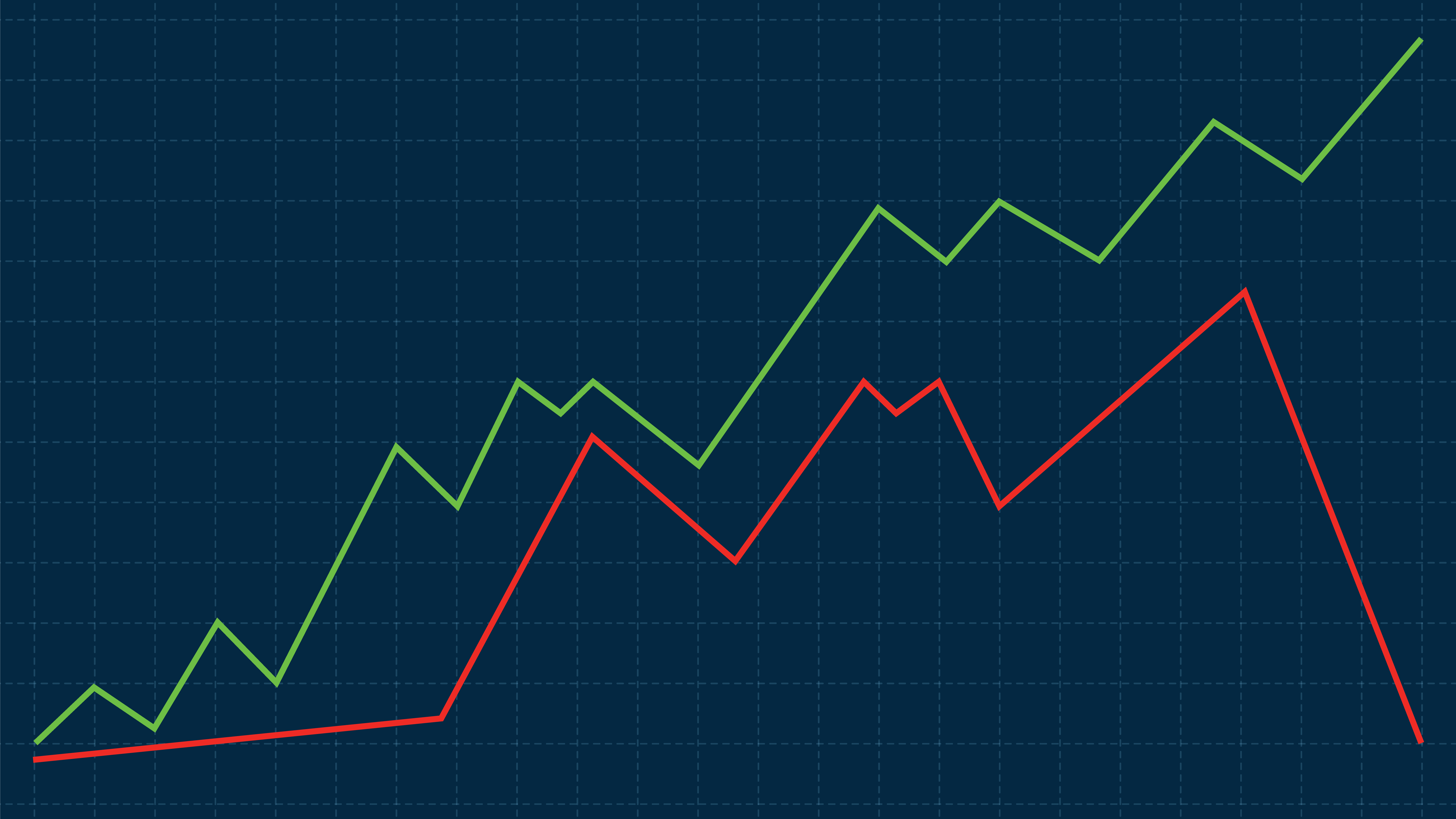

The cryptocurrency market is well known for its volatility. As such, trading Bitcoin can be very rewarding, but it also comes with significant risks. Prices can fluctuate dramatically within short periods, dropping or rising by several thousand dollars in 24 hours, which can result in significant gains or losses. Traders interested in trading Bitcoin or another cryptocurrency should first find a cryptocurrency exchange, such as Limitlex, and open a trading account.

Before trading begins, it is important to put risk-management strategies in place, such as stop-loss orders, in case the market takes a turn for the worse. It is also a good idea to diversify a crypto portfolio with a variety of more popular assets, such as Bitcoin, Ethereum and Solana, and smaller altcoins or even new launches, which have the potential to bring in significant gains. However, as with any investment, traders should monitor the crypto market closely once they have invested and never invest more than they are willing to lose.

To learn more and start trading with Limitlex, visit limitlex.com.