Crypto seasons, encompassing spring, summer, autumn, and winter, mirror the general characteristics and sentiment of their natural counterparts. On the one hand, crypto summers tend to be bright and positive, while on the other, crypto winters are known for their gloominess. Crypto seasons are generally characterized by the behavior of the Bitcoin and altcoin market, and the relationship between the two. If traders successfully manage to read and predict these seasons, it can prove very fruitful, particularly in crypto spring.

This article aims to provide an overview of the four crypto seasons, what they represent, and offer some insights into the overarching cycles of the cryptocurrency market.

What are altcoins?

Altcoins, short for ‘alternative coins,’ can be understood as any cryptocurrency or token that is not bitcoin. Since Bitcoin was first created in 2009, thousands of altcoins have been brought into the market, each with its own unique features that often address the former’s shortcomings. Some popular altcoins include Ethereum, Ripple, Litecoin, Solana, and Cardano. While Bitcoin remains the most recognized cryptocurrency and the most dominant in terms of market capitalization, altcoins can offer diversification to a crypto investor’s portfolio and present new innovations and technologies within the cryptocurrency space.

The four crypto seasons

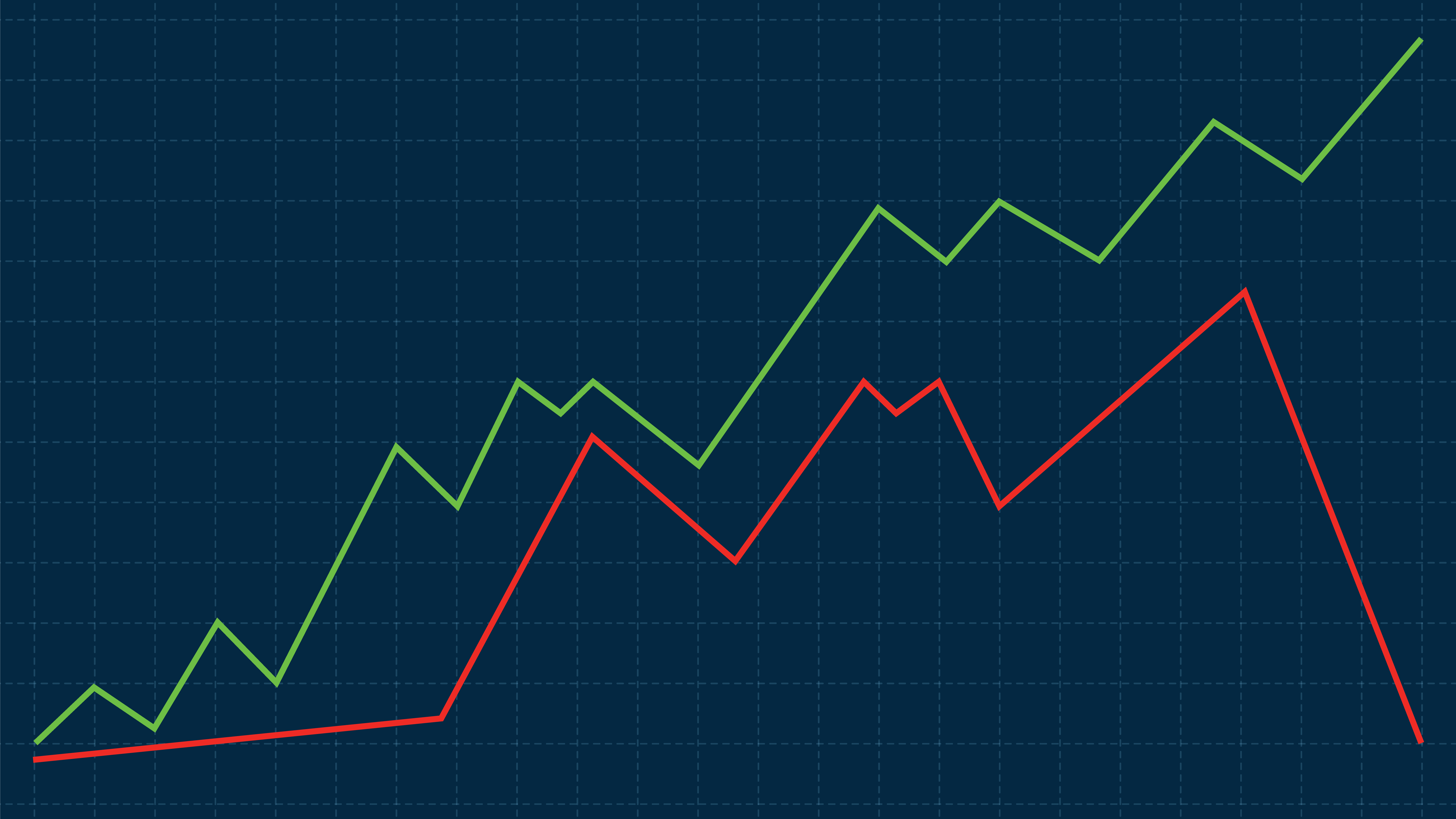

The four crypto seasons are spring, summer, autumn, and winter, and aim to describe the different cycles experienced by the cryptocurrency market. Each season, or cycle, is characterized by certain market movements and influences driven primarily by altcoins. In fact, crypto spring is often referred to as the altcoin season, as it refers to a period in which altcoins ‘flourish’ and outperform Bitcoin. The four seasons can be generally broken down as follows:

Spring: As mentioned above, spring is also known as altcoin season, given the influence these non-Bitcoin cryptocurrencies have on the market. Given the resurgence and renewed growth of altcoins, it tends to be a chance for traders to diversify their cryptocurrency portfolios and potentially earn higher returns. Interest in Bitcoin decreases.

Summer: At the time of writing, many in the crypto space are saying that we are well on our way into crypto summer. This is due to the fact that Bitcoin is taking center stage. With the fourth halving on the horizon, prices have been surging, hitting a new all time high in early March 2024, and are predicted to rise even higher following the event. As part of this cycle, altcoins tend to suffer as attention is focused on Bitcoin.

Autumn: In the crypto space, autumn is characterized by stability. Following a rise in Bitcoin’s value, its price stabilizes, and interest tends to dip, making room for altcoins and price corrections in the market.

Winter: The term “Crypto Winter” was trending throughout 2023, until the real winter started to close in. It can be compared to the term “bear market”, used for both the stock and crypto markets, so called due to its downward trajectory, negative sentiment, and lower-than-average values. The start of a crypto winter is sometimes marked by a double-digit percentage drop in a particular asset in the market, such as Bitcoin. This can also have a knock-on effect on general investment enthusiasm, although it can be a good time for traders to sweep up low-priced assets before spring comes around again.

Reading the crypto seasons

Given the cryptocurrency market's volatility, it is impossible to predict when each season will begin and end. However, given the cyclical nature of the crypto market, much like the stock market, it is possible to read the general trends of value among Bitcoin and altcoins. In crypto summer, traders should be aware that this period of sky-high prices probably won’t last forever. Likewise, in crypto winter, traders might take the opportunity to buy cryptocurrencies or other assets while prices are low.

The cryptocurrency market is prone to speculation and volatility and is influenced greatly by both sentiment and the decisions of high-volume holders (also known as whales). Investments require thorough research, particularly if altcoins are new to the market, and portfolios should always be diversified. Traders must bear in mind the inherent risk involved in buying and selling cryptocurrencies and never invest more than they are willing to lose.

To learn more and start trading with Limitlex, visit limitlex.com.