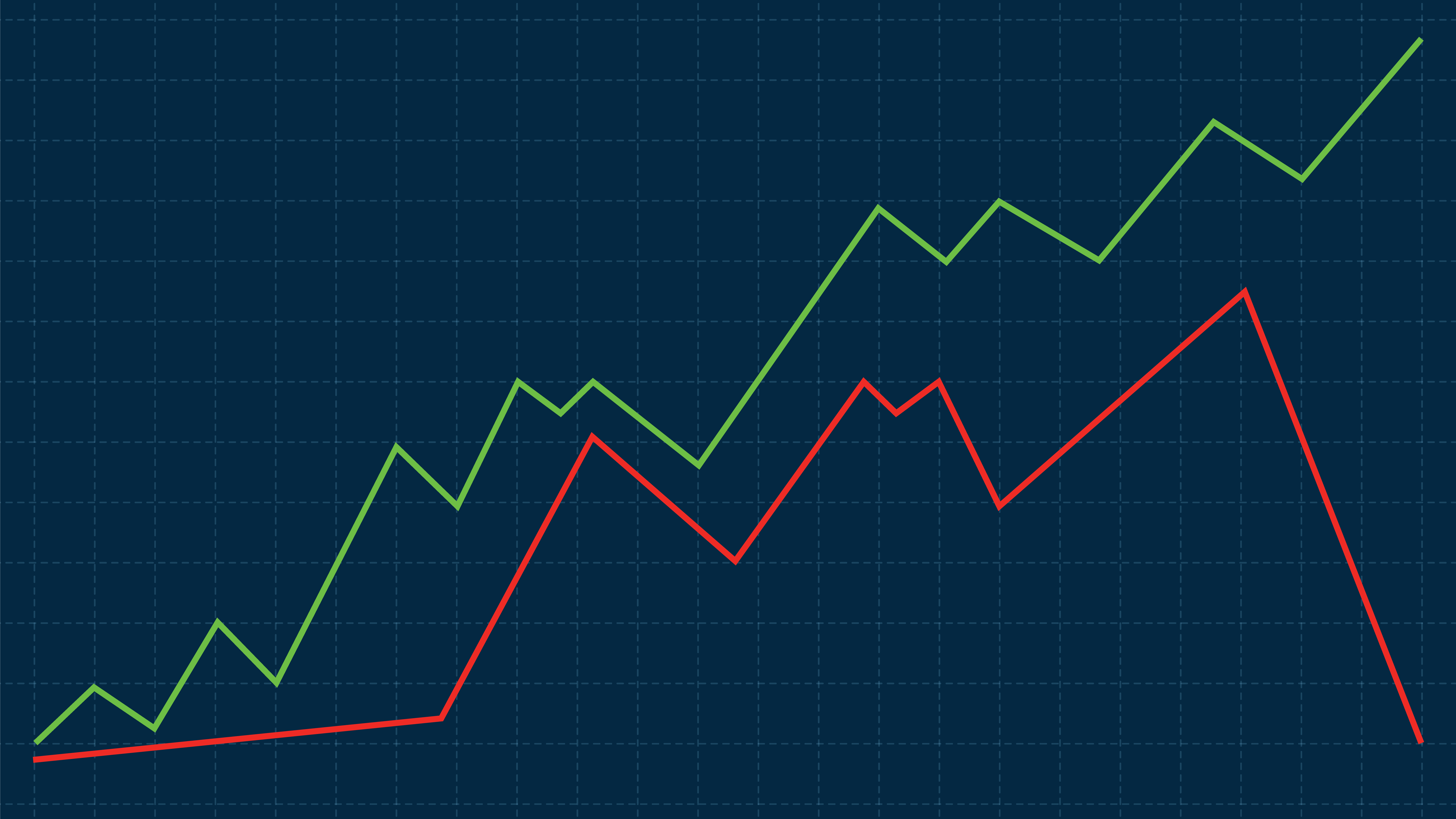

Bitcoin (BTC) has held a more or less steady position since late November 2024, floating around the $96,000 to $98,000 mark, despite hitting a new all-time high of over $109,000 in mid January 2025. But analysts suggest that recent activity shows investors may be dropping their risk of exposure, as Bitcoin has started to flow out of derivative exchanges and into spot exchanges, indicating the start of a bearish period. With the evolution of regulatory frameworks around the world integrating more crypto-friendly policies, and support from government leaders such as President Donald Trump, it seemed there was no stopping Bitcoin from flying even higher.

But should investors and traders tread more carefully over the coming weeks? Is a Bitcoin (BTC) bear market possible, or even probable?

Bitcoin’s recent price fluctuations

Over the past six months, Bitcoin has experienced some eyebrow-raising moments. In November 2024, Bitcoin surged from around $70,000 to over $96,000, driven by the election of President Donald Trump, who had previously laid out a series of pledges for favorable crypto policies in the U.S. This momentum continued into the new year, and Bitcoin hit a colossal new all-time high of over $109,000 in mid-January. But since that peak, the leading crypto has faced downward pressure and is currently trading at around $95,000.

Several factors have contributed to this recent decline. Despite initial optimism, the Trump administration has yet to fulfill key promises, such as establishing a strategic Bitcoin reserve, which has sparked disappointment among the crypto community. They have however been active in other areas of policy, particularly on the subject of tariffs, which is fueling uncertainty in global markets and contributing to a risk-off sentiment among investors. Inflation data released in February also came in higher than anticipated, which has put pressure on high-risk assets such as Bitcoin.

Is a Bitcoin (BTC) bear market possible?

While it is still too early to call the start of a full-blown bear market, some warning signs are beginning to rear their bearish head. The shift of Bitcoin from derivative exchanges to spot market suggests traders might be locking in profits or bracing for a market turndown, amidst broader macroeconomic uncertainty, as the Federal Reserve signals that interest rates may stay elevated longer than expected. Higher rates have historically made more traditional investments like bonds and cash savings more attractive, and could potentially draw liquidity away from Bitcoin.

That being said, Bitcoin has weathered similar pullbacks in the past, and often rebounded stronger following periods of volatility. Some analysts maintain that a long-term bullish trend remains probable, particularly given the increased institutional adoption and ever-clearer regulatory frameworks in major markets. For instance, the State of Wisconsin Investment Board more than doubled its shares in the iShares Bitcoin Trust ETF to 6 million at the end of 2024. Similarly, MicroStrategy shows no signs of slowing down, having announced plans to raise $2 billion through convertible notes to acquire more Bitcoin, reinforcing its position as the largest corporate holder of the cryptocurrency with around 480,000 bitcoins.

Long-term future prospects for Bitcoin

Despite recent corrections across the crypto market, analysts project substantial growth for Bitcoin over the coming months and years. Anthony Scaramucci, head of the leading crypto-focused ETF, CRPT, has recently predicted that Bitcoin could reach $200,000 in 2025. Similarly, investment manager VanEck estimates that if bills proposed across U.S. states to establish state-level Bitcoin reserves are enacted, it could lead to the purchase of around 247,000 bitcoins, which would inject some $23 billion into the crypto market. With greater institutional investment potentially on the cards, Bitcoin’s long-term prospects look promising. While a bear market might be possible, it seems Bitcoin is likely to bounce back as adoption continues to grow.

For more information on investing in crypto, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.