In the fast-paced world of crypto trading, where assets’ value can shift thousands of euros in a matter of minutes, crypto AI trading bots have provided investors and traders with a helping hand when it comes to discerning patterns and executing trades with superhuman capabilities. As in most other sectors that hinge on technology, trading has begun to incorporate the power of artificial intelligence (AI) to process and analyze vast datasets and make decisions faster and with greater precision than is humanly possible. However, while AI trading bots offer significant advantages, it's crucial for traders to understand their limitations and the inherent risks involved.

In this article, we take a closer look at the functionalities of crypto AI trading bots, their benefits, and limitations.

What are crypto AI trading bots?

Like many innovations based on AI, crypto trading bots have been introduced into the crypto trading space to enhance accuracy, effectiveness and efficiency for users. In recent years, algorithmic trading that employs algorithms based on technical indicators, trends, and market data in order to enable faster and more precise decisions, have been used to streamline trading operations, minimize errors and respond faster to market movements. Recent data suggests that between 60% and 75% of trading volume in major U.S., European, and Asian financial markets is generated by algorithmic trading.

Crypto AI trading bots enhance this process by incorporating machine learning and data analysis, allowing them to identify patterns, predict market movements and adapt trading strategies in real time. Unlike previously employed algorithms that followed rules set by their human operators, AI-driven bots evolve autonomously as they learn, making them highly effective allies for the volatile crypto trading market. Given the high percentage of algorithmic trading, it is likely that a generous portion is also executed using AI trading bots.

The benefits of using crypto AI trading bots

Crypto AI trading bots offer numerous advantages, and not just for experienced traders; they can also be hugely advantageous for novice traders. One key benefit is their ability to operate 24/7, able to keep a watchful eye on the ever-open crypto markets to ensure no opportunity is missed given the crypto market’s high volatility. Unlike human traders, AI trading bots do not suffer from fatigue or confusion, allowing them to continue working at full capacity when a human would need to rest.

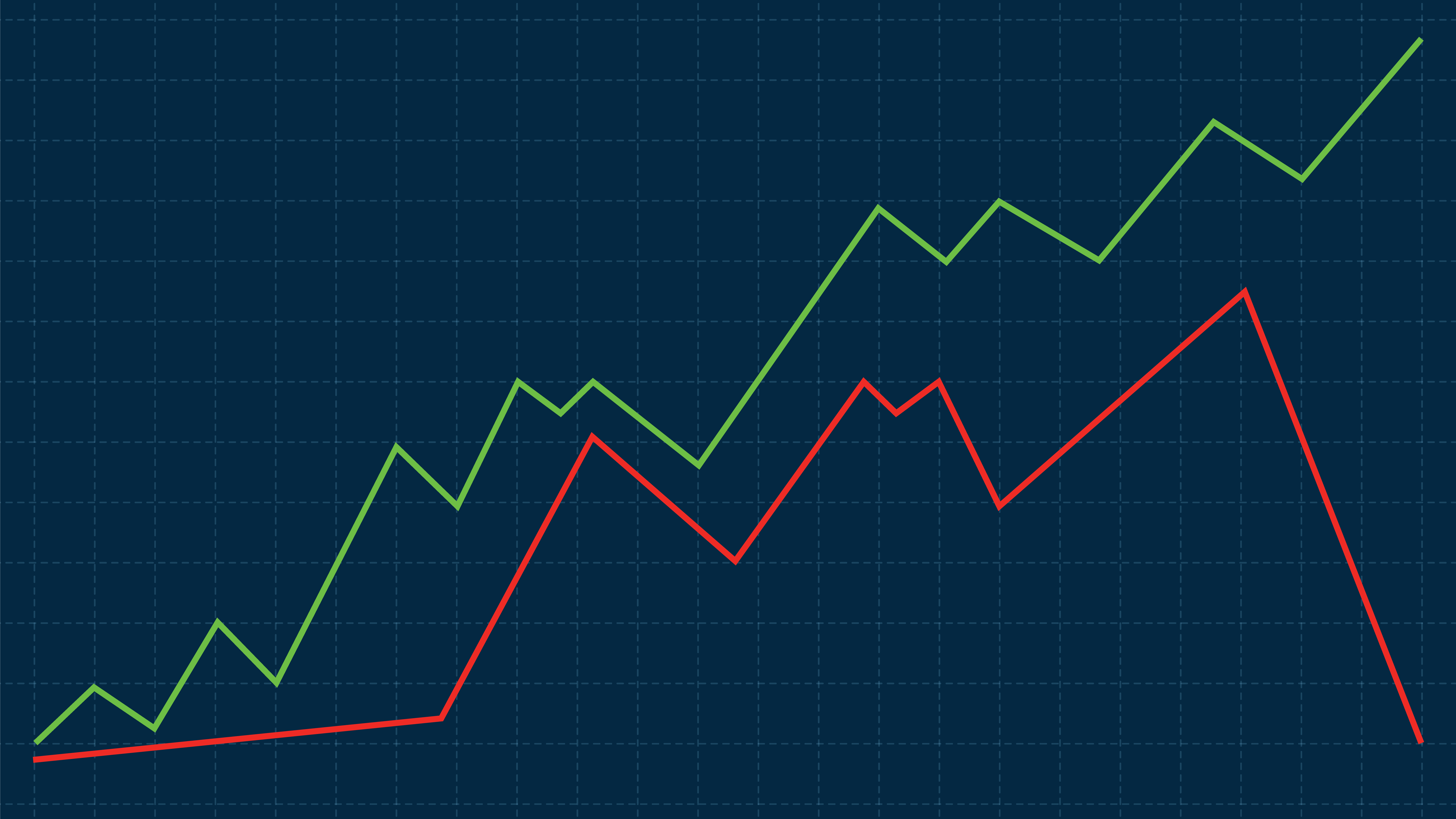

Another huge advantage of AI trading bots is their ability to adapt. These bots use machine learning to analyze vast amounts of data, identify trends and refine their strategies in real time, reacting to market changes at a second’s notice. This ability to adjust autonomously ensures they remain effective in dynamic markets where traditional algorithms might falter. This autonomy and speed also saves time, making it possible to capitalize on fleeting opportunities, and allowing human traders to focus on other areas, such as higher-level strategies.

AI trading bots can’t feel emotion

AI trading bots are also not susceptible to emotional bias, meaning they make consistently objective decisions based purely on data, which maximizes profitability and reduces risk. According to a global research study by GNY.io, some 20% of traders’ losing trades are based on emotional rather than rational decisions based on data analysis.

The Turtle Trading System, developed in the 1970s by Richard Dennis, demonstrated that traders who stuck strictly to the program’s rules (namely, not allowing emotions, sentiment and bias to get in the way) would be successful. One example was to “Look at prices rather than relying on information from television or newspaper commentators to make your trading decisions”, or “Plan your exit as you plan your entry. Know when you will take profits and when you will cut losses”.

The principle aligns perfectly with the strengths of AI trading bots, which are designed to operate purely on data-driven strategies, free from emotional interference. By eliminating the pitfalls of human psychology, these bots provide a more disciplined and reliable approach to trading, mirroring the success seen in systems such as Turtle Trading.

For more information on investing in crypto, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.