Bitcoin has never moved in straight lines, and it rarely announces its intentions in advance. It drifts, consolidates, tests conviction, and then, often when attention has shifted elsewhere, it reminds everyone why they started paying attention in the first place. As 2026 starts to warm up its engines, the question returns with quieter confidence than in past cycles: how high could bitcoin actually go this year? The terrain is different now. Bitcoin no longer trades in isolation, powered purely by retail enthusiasm and speculative momentum. Institutional capital has changed the weight of the market, ETFs have reshaped how demand enters the system, and macro conditions exert a far more consistent influence on price. And yet, beneath all of that, the core mechanics remain the same: fixed supply, a global settlement network and a protocol that continues to operate regardless of sentiment, policy, or prediction.

In this article, we’ll explore what analysts are forecasting for bitcoin in 2026, the forces that could carry it higher, and the limits that may come into play if conditions change.

The range of expectations is wide, and that’s the point

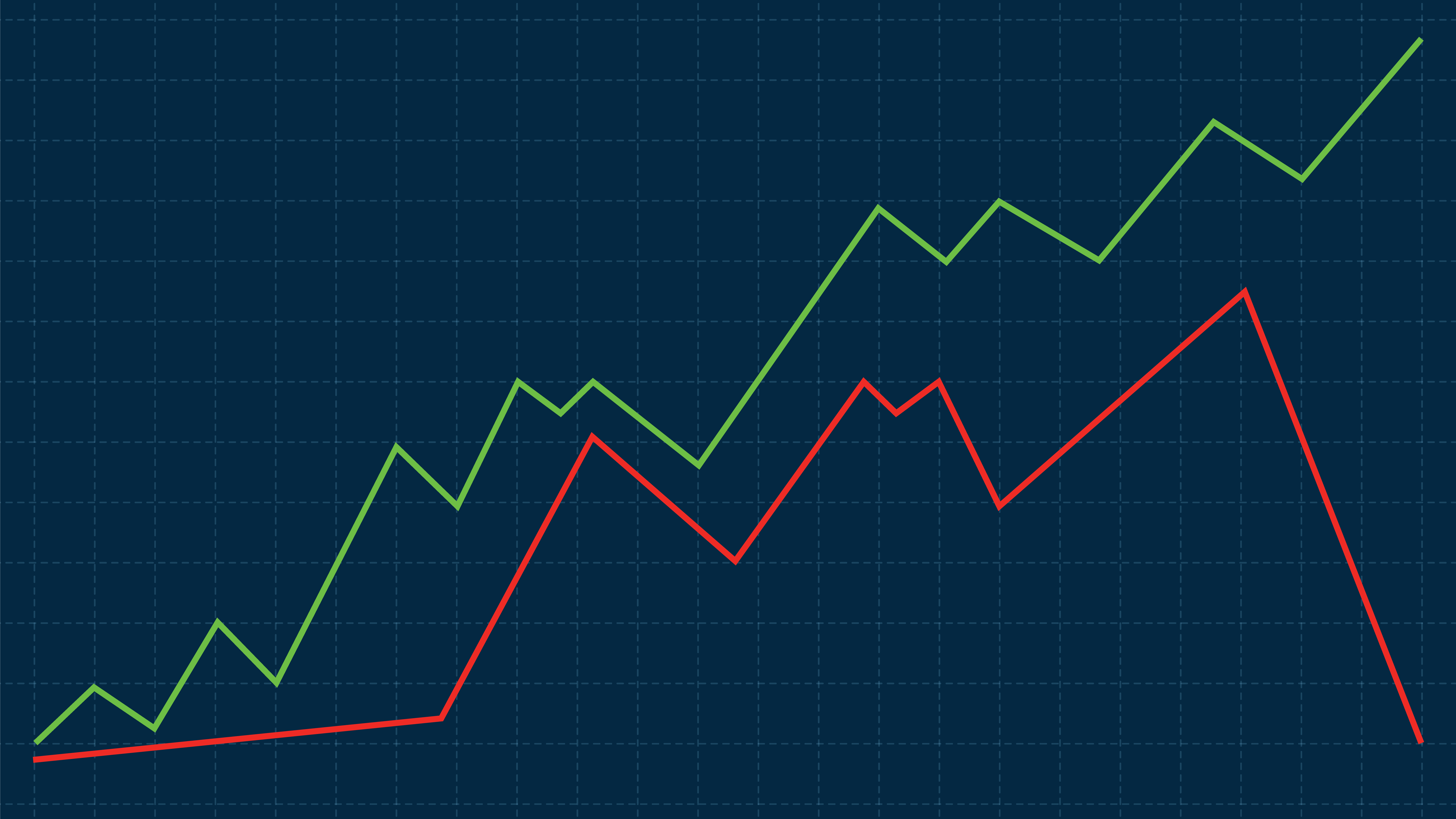

Ask a room full of analysts where bitcoin could land in 2026 and you won’t get a consensus, but you will get a range. Some forecasts place bitcoin comfortably above $150,000, while others, drawn from analyst roundups published by CNBC and echoed across financial media, stretch toward $200,000 or even $225,000. Some more cautious voices warn that a pullback toward lower six figures, or below, remains entirely possible. That spread may look chaotic, but it reflects the reality that bitcoin is no longer dominated by singular narratives. It’s grown into an asset shaped by macro forces, institutional behavior and global liquidity, which can all introduce uncertainty as well as opportunity.

What’s also interesting is that even the more conservative projections rarely dismiss the idea of sustained six-figure prices altogether. Instead, the debate centers on timing and how much capital follows new rails into the market. Bullish forecasts tend to lean on continued ETF inflows, improving regulatory clarity, and bitcoin’s historical tendency to overshoot once confidence builds. Bearish scenarios point to macro setbacks, cooling risk appetite, or simple exhaustion after a strong run. Taken together, bitcoin’s path in 2026 could be more about how far conditions allow it to run before gravity raises its head.

What might carry bitcoin higher in 2026?

If bitcoin pushes higher in 2026, its momentum is most likely to come from structured growth. Spot ETFs have changed how capital enters the market, turning what was once opportunistic buying into something more persistent and programmatic. With potential easing of interest rates and better liquidity, bitcoin is becoming an asset that benefits from positive macroeconomic conditions rather than resisting them. In past cycles, this kind of alignment has tended to amplify momentum rather than dampen it.

But there’s also a psychological component that’s easy to underestimate. Bitcoin has a long history of spending extended periods rebuilding conviction before accelerating rapidly once key thresholds are cleared. Six-figure prices, once unthinkable, are now part of the baseline conversation, which changes how both institutions and long-term holders behave. That doesn’t guarantee a straight line on the graph, but it does suggest that if demand builds steadily and supply remains constrained, price discovery can happen faster than expected. There just needs to be enough participants that believe it’s possible.

Where may limits appear?

Even in constructive conditions, bitcoin has always encountered moments where momentum slows and reality catches up. As prices climb, the market naturally tests itself as long-term holders take profits, new buyers hesitate and macro conditions reassert their influence. Forecasts pushing well beyond the $200,000 mark tend to assume near-perfect alignment across liquidity, adoption and sentiment, and while that is possible, it’s not guaranteed. Markets rarely move in straight lines for long, especially once expectations begin to harden around a single outcome.

As such, 2026 is best viewed through a range, rather than as a target. Bitcoin may well explore levels that once felt out of reach, but how long it stays there will matter just as much as how high it climbs. For investors and traders, the more interesting question isn’t whether bitcoin can reach an extreme price, but whether the conditions exist to support it once it gets there. Bitcoin has never lacked ambition. Its ceiling in 2026 will likely be determined by whether the current market momentum is sustained, or whether natural pressures cause even the strongest upward trends to temporarily pull back.

For more insights and reflections on crypto trends, crypto trading, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.