The Crypto Fear and Greed Index is a tool designed to gauge current cryptocurrency market sentiment, based in large part on the significant role psychology plays in trading. The volatility of the crypto market can sometimes cause steep drops or surges in value, representing shifts worth thousands of dollars, often in just a few hours. These shifts can incite fear in investors and traders with a large stake in crypto.

The idea behind the Fear and Greed Index was initially devised by the finance channel CNNMoney for the stock market. Today, however, it is more closely associated with cryptocurrencies and monitoring market sentiment surrounding Bitcoin, the original and currently the highest-valued Bitcoin.

This article, therefore, takes a closer look at how investors and traders could use the Crypto Fear and Greed Index to monitor the market and help inform and support the decision-making process regarding buying and selling Bitcoin.

How does the Crypto Fear and Greed Index work?

The Crypto Fear and Greed Index is calculated based on a meticulous analysis that considers a number of parameters. Volatility levels are assessed by comparing current values to historical averages over 30 and 90 days. A rise in volatility often indicates a fearful market. The current market momentum is also compared to the current market volume, which indicates levels of buying activity. For example, when buying volumes outpace the longer-term momentum, it signals the market becoming greedy. These are the two primary indicators that help determine shifts toward fear or greed in the crypto market.

But the Index is also fed with other more qualitative data on social media engagement, surveys, Bitcoin dominance and Google Trends. High rates of interaction on social media platforms could suggest growing interest and potential greed, while surveys provide a more direct way of identifying public perceptions of the market. The dominance of Bitcoin is used to identify risk appetite. For example, when it's rising, people may be more cautious about their crypto choices and invest in safer assets such as Bitcoin. Falling dominance suggests a riskier sentiment, indicating investors are choosing to diversify more and shift towards riskier alt-coin investments. Finally, Google Trends data provides insights into broader interest levels by examining the kinds of information people request through the search engine, such as “Bitcoin price manipulation.”

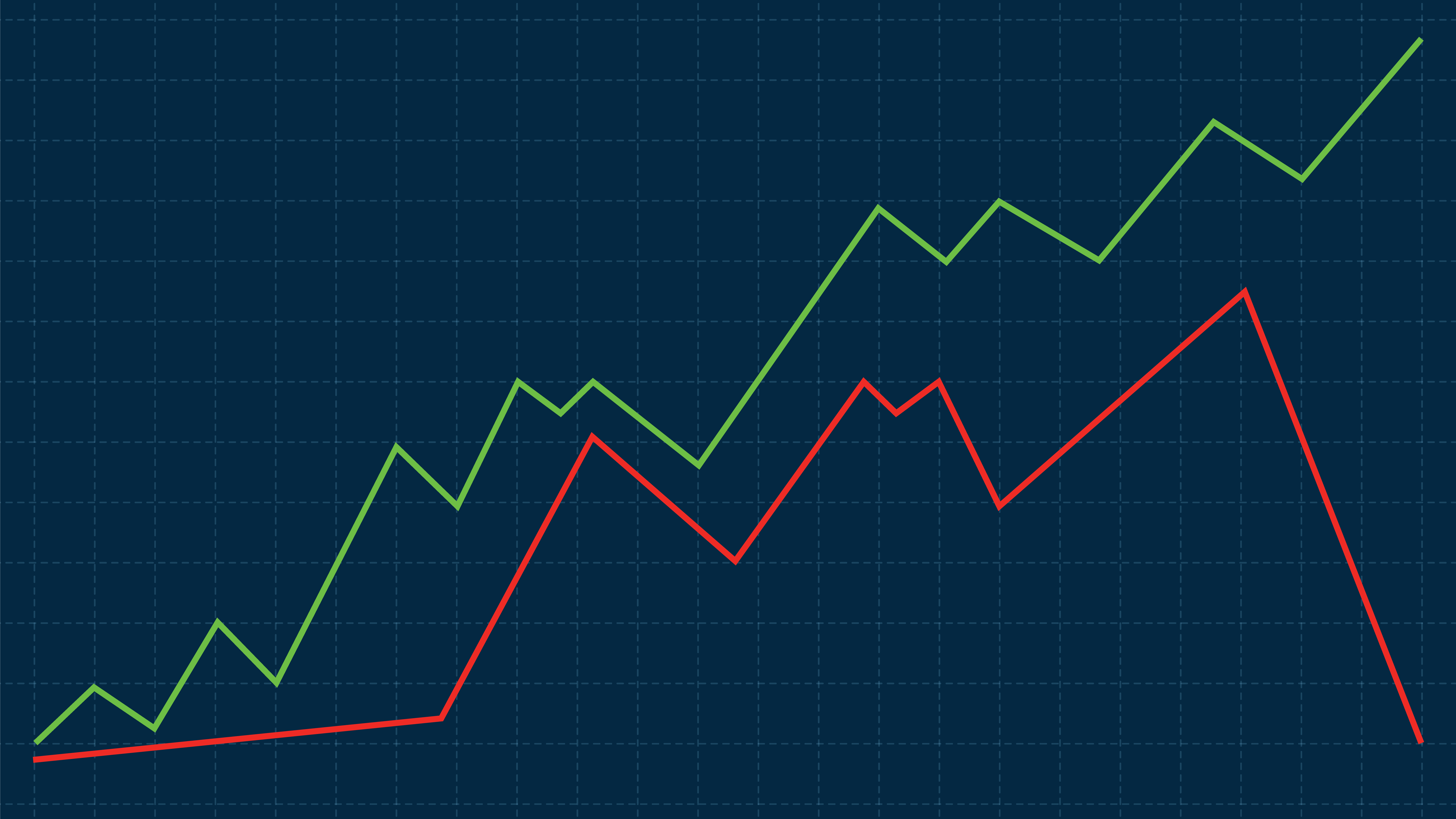

The Crypto Fear and Greed Index is divided into four color-coded categories:

- 0-24: Extreme fear (orange)

- 25-49: Fear (amber/yellow)

- 50-74: Greed (light green)

- 75-100: Extreme greed (green)

The Crypto Fear and Greed Index on the 12th of April 2024

How to use the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is not generally used to gauge long-term trends in the cryptocurrency market. Instead, the Index score tends to reflect and indicate new events, trends and short-term shifts in the market. As such, many investors and traders use the Index as a short-term indicator and as an aid for analyzing market sentiment in order to inform investment decisions.

For more information on investing or to start trading today, visit limitlex.com.