Every trader begins hoping they will be the exception; that they will not fall into the trading traps so many first-time and veteran traders are victim to. But, the good news is that these traps are completely avoidable, as they have little to do with market volatility and everything to do with psychology and decision-making. The reality is that profitable trading is not about catching the next price surge. It is about managing risk, maintaining emotional control, and following a well-defined strategy. These principles are what separate professional traders from those who rely on impulse or luck.

In this article, we explore the three common mistakes traders make and practical ways to prevent them.

Number 1: Trading without a strategy

Many traders start by reacting to market movements instead of planning their own. They follow hype, chase price swings, or copy others’ trades without clear goals. This lack of structure turns trading into speculation and often leads to emotional decisions and unnecessary losses. A solid strategy turns reaction into discipline. It defines how you enter and exit trades, how much risk you take, and how you measure success. For example, a basic plan should include:

- Clear entry and exit points based on analysis, not emotion

- Position sizing rules to manage exposure

- Risk limits to protect your capital

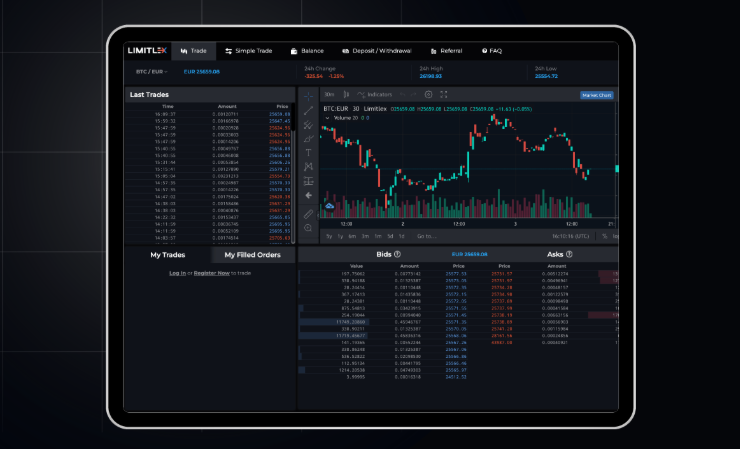

At Limitlex, we provide tools to help traders stay focused and stay systematic, such as limit orders. You can also place a “Basket Buy” order to purchase multiple cryptocurrencies at once, and a “Sell All” order to dispose of your portfolio (or a portion of it) for EUR, USDT or BTC with one click. We also offer real-time email or Telegram notifications to keep you aware of market movements. A strategy cannot remove uncertainty completely, but it can replace guesswork with structure, which is the first step toward consistent results.

Number 2: Ignoring risk management

One of the most common mistakes traders make is failing to manage risk effectively. Many focus entirely on potential profits and overlook the importance of protecting their capital. Without clear risk controls, a single poor decision can offset many successful trades. Effective risk management begins with clear limits and reliable tools. With Limitlex, traders can place limit orders to control the price at which they buy or sell assets. This feature helps traders avoid emotional decisions and ensures that orders are executed only under predefined conditions. The Basket Buy and Sell All options allow traders to diversify or rebalance their portfolios efficiently, reducing exposure to a single asset. A disciplined trader should always:

Set clear stop levels to limit potential losses

Avoid overexposure by spreading investments across several cryptocurrencies

Use limit orders to control execution prices and prevent impulsive trades

Number 3: Letting emotion get the better of your decisions

Emotions are one of the biggest obstacles to consistent trading performance. The most common culprits: fear, greed, and impatience. These emotions can push traders to abandon their strategy and make impulsive decisions, like buying too late, selling too soon, or chasing losses. Unfortunately, these think-fast-act-fast decisions are rarely accompanied by due analysis. At Limitlex, we aim to create a trading environment that supports discipline and clarity.

Our platform’s limit orders allow traders to define exact entry and exit prices, removing the need to react to all market movements. Once again, features like Basket Buy and Sell All simplify portfolio management, and help traders act strategically instead of emotionally. As do our real-time email and Telegram notifications, which keep traders informed, so they can make calm, informed decisions based on data rather than market noise.

For more insights and reflections on crypto trends, crypto trading, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.