While many crypto natives and traders exchange cryptocurrencies with US dollars due to geographic location or limited exchange options, there is an equally sizable market for trading cryptocurrencies with Euros. For instance, for millions of traders living in Europe, a typical trading pair is Bitcoin to Euro (BTC/EUR). There are many advantages to choosing an exchange that permits crypto to Euro trading, such as increased simplicity, risk management, time-savings and cost-efficiency, especially for traders living in Europe.

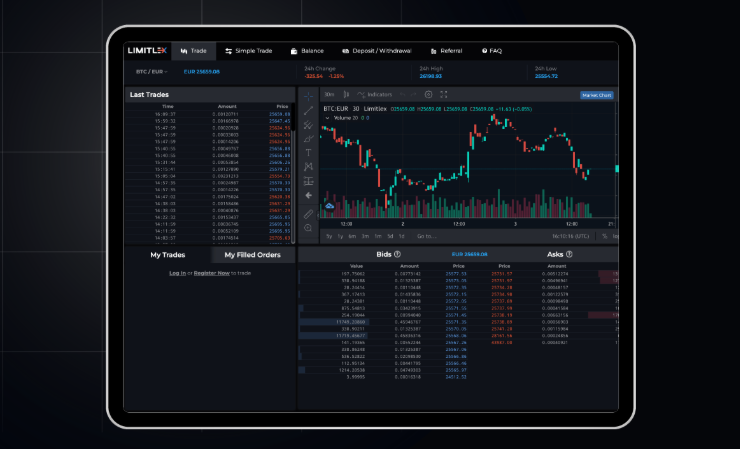

This article delves into the advantages of utilizing Limitlex as a platform for cryptocurrency and Euro trades.

What are trading pairs?

Trading pairs, sometimes known as crypto pairs, are assets that can be traded for each other on an exchange, for example Bitcoin to Litecoin (BTC/LTC). It is important to understand crypto pairs as it allows you to compare costs and see the relative value of particular assets, such as the comparative costs of one Bitcoin versus one Litecoin. It can also be useful for expanding crypto holdings beyond the most common coins, as some crypto can only be bought using other cryptocurrencies.

The advantages of trading directly between cryptocurrencies and Euros

The main advantages of using Limitlex to trade between crypto and Euros are simplicity, precision and cost-efficiency. Limitlex eliminates the need for over-complex currency conversions, for example, from BTC to USD, and USD to Euro, enabling faster and more informed decisions. Trading directly between crypto and the Euro also mitigates the risk of being exposed to market volatility. It allows traders to employ a much cheaper process that incurs just one set of gas fees.

A native solutions for EU traders

Limitlex’s native integration of the Euro also provides traders operating in Europe (and in Euros) with a much clearer assessment of the real value of their investments. This significantly streamlines the decision process and allows investors to evaluate the performance of their portfolio in a single, more relatable currency.

Limitlex is audited by the EU

Operating within the European Union means navigating through a set of regulations and standards. Traders in this region prioritize platforms that comprehend these intricacies and adhere to them. LimitLex is audited by the European Union and fully aligned with the EU regulatory framework, ensuring not just a profitable but also a secure and trustworthy trading environment.

In essence, the advantages of trading directly between cryptocurrencies and Euros, especially through a platform like Limitlex, extend beyond convenience. They encompass simplicity, precision, cost-efficiency, and regulatory alignment, offering traders in Europe a comprehensive and reliable solution for navigating the evolving landscape of cryptocurrency trading.

Visit limitlex.com for more information.