Cryptocurrency trading has become a popular way for investors to profit from the volatile and fast-moving digital currency markets. However, it's also a high-risk and complex undertaking that requires knowledge, skill, and a disciplined approach. In this blog post, we'll explore five essential tips for successful cryptocurrency trading.

1. Educate Yourself

Before you start trading cryptocurrencies, it's important to educate yourself on the fundamentals of this new asset class. This means understanding the technology behind cryptocurrencies, such as blockchain, as well as the different types of cryptocurrencies and their respective use cases.

It's also important to learn about trading strategies, risk management, and market analysis techniques. There are many resources available online, such as blogs, forums, and educational courses, that can help you build a solid foundation of knowledge.

2. Develop a Trading Plan

Once you have a good understanding of cryptocurrencies, it's time to develop a trading plan. This plan should outline your trading objectives, risk tolerance, and strategies for entering and exiting trades.

Your plan should also include guidelines for managing risk, such as setting stop-loss orders to limit your losses if a trade goes against you. Having a well-defined trading plan can help you stay focused and disciplined, which is essential for success in the volatile cryptocurrency markets.

3. Use Technical Analysis

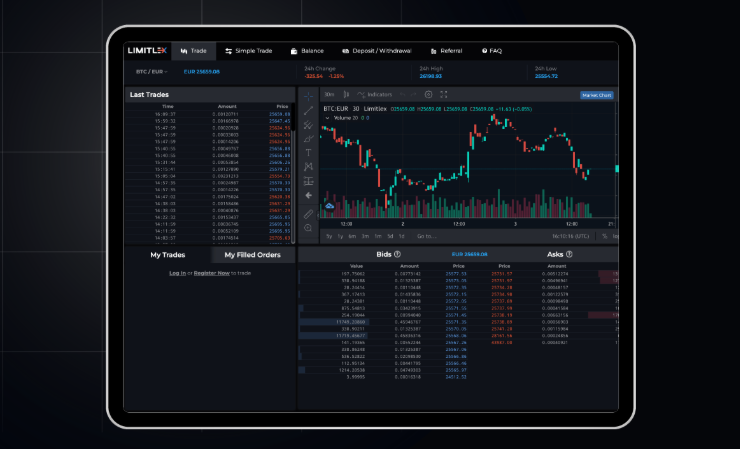

Technical analysis is a popular method for analyzing financial markets, including cryptocurrencies. This involves using charts and indicators to identify trends and patterns in price movements, which can help you make informed trading decisions. Some popular technical indicators used by cryptocurrency traders include moving averages, relative strength index (RSI), and Bollinger Bands. It's important to remember that technical analysis is not foolproof, and there is no single indicator or method that can guarantee success in the markets.

4. Keep Your Emotions in Check

Emotions can be a trader's worst enemy, particularly in the high-stress world of cryptocurrency trading. Fear, greed, and FOMO (fear of missing out) can lead to impulsive and irrational trading decisions, which can result in significant losses.To be a successful cryptocurrency trader, you need to keep your emotions in check. This means staying calm and objective, and sticking to your trading plan, even in the face of volatility and uncertainty.

5. Diversify Your Portfolio

Finally, it's important to diversify your cryptocurrency portfolio. This means investing in a range of cryptocurrencies, rather than putting all your eggs in one basket. Diversification can help you manage risk and protect your portfolio from the volatility of individual cryptocurrencies. It can also help you take advantage of different market trends and opportunities.

Cryptocurrency trading can be a lucrative but high-risk activity. By educating yourself, developing a trading plan, using technical analysis, keeping your emotions in check, and diversifying your portfolio, you can increase your chances of success in this exciting and dynamic market. However, it's important to remember that no trading strategy is foolproof, and there is always a risk of losses in the markets.