Cryptocurrency regulation in the United States is set to dramatically shift under the Trump administration. This shift was set in motion on Friday 7th of March as the White House hosted the Trump Administration’s Crypto Summit, the first event of its kind at the government level. During his presidential campaign, Donald Trump made several pledges regarding government support and acceptance of cryptocurrency, which until last week had remained unfulfilled. One of these pledges was to make the U.S. government’s stockpile of Bitcoin into a Strategic Bitcoin Reserve, described at the Crypto Summit as a “digital Fort Knox”. The discussions that took place at the Summit have sparked mixed reactions within the crypto community. The debate has arisen over whether it is right to favor one crypto over another, while experts have also celebrated the plans laid out for a broader regulatory framework.

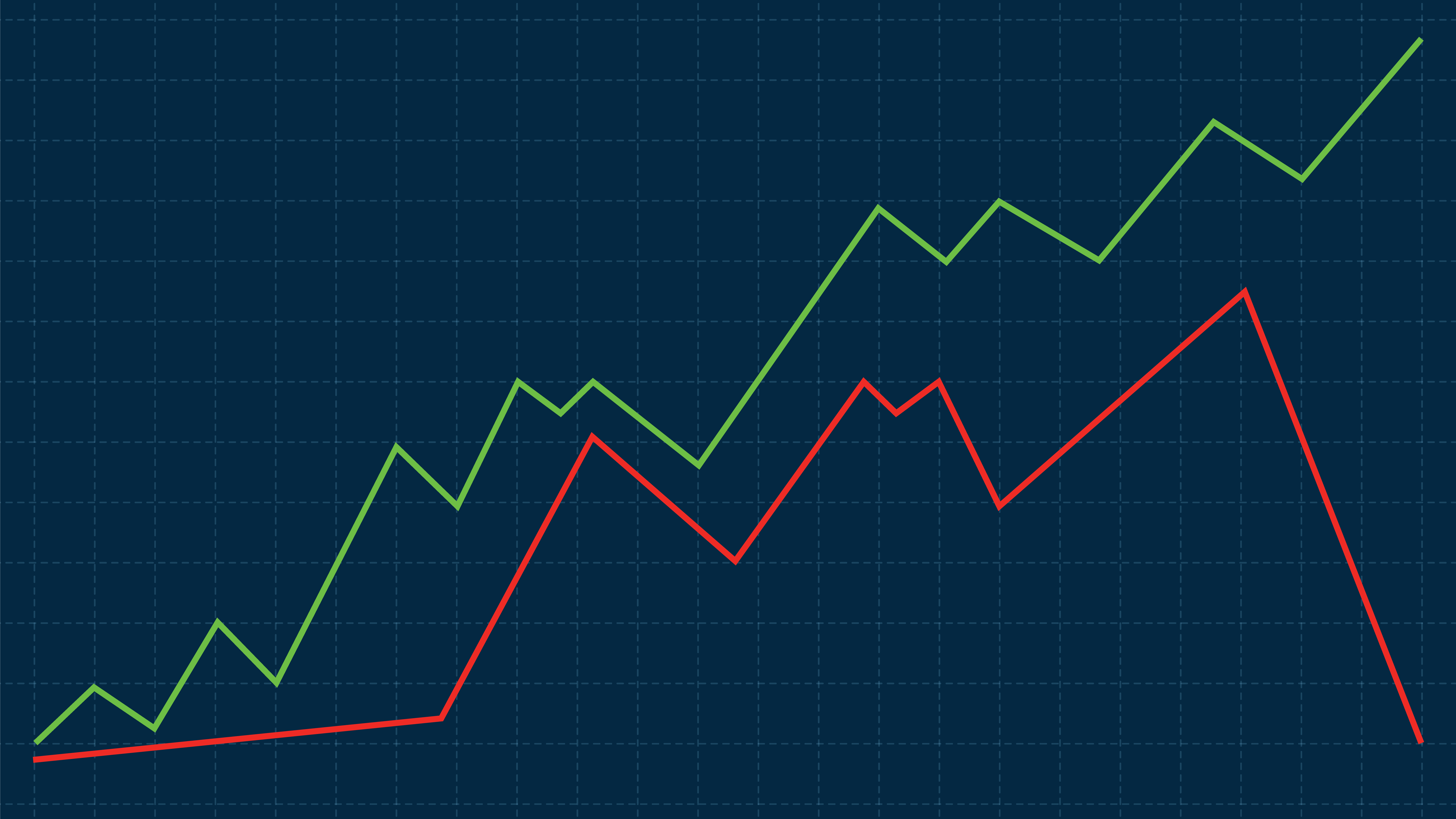

With the crypto market in the throes of a shaky correction, will the Trump Administration’s Crypto Summit be able to steer the market towards greater optimism and confidence?

Crypto under President Biden

Under President Biden’s administration, crypto regulation largely centered on crackdowns and SEC investigations into crypto businesses. The Biden administration positioned itself as a watchdog for consumer protection, and the SEC took a firm stance against unregistered crypto platforms, token sales and DeFi services. While some argued that this strict enforcement was necessary to protect investors from malicious actors, critics claimed the government’s position was stifling innovation.

Despite these challenges, the Biden administration did make efforts to explore the potential of digital assets. The President’s Working Group on Financial Markets conducted reports that proposed regulatory frameworks that would enhance consumer protection. Federal agencies were also tasked with studying the feasibility of a U.S. Central Bank Digital Currency (CBDC), reflecting some openness to the evolving financial ecosystem. After barely two months in office, the Trump’s administration has already begun to introduce a new, more cooperative approach to digital asset management.

A new era for crypto in the U.S.

In contrast to his predecessor, President Trump has adopted a much more collaborative approach towards the cryptocurrency industry. Just days before the Trump Administration’s Crypto Summit on Friday the 7th of March, the White House announced the creation of a Strategic Bitcoin Reserve, which will be funded with bitcoin seized through criminal or civil asset forfeiture proceedings, ensuring that taxpayer funds are not used.

Regarding other digital assets, the Trump administration has also announced the establishment of a U.S. Digital Asset Stockpile to manage other cryptocurrencies obtained through similar means. The latter was well received by both attendees and onlookers to the Crypto Summit, with influential voices such as Ripple CEO Brad Garlinghouse, who welcomed Trump's recognition that the world of cryptocurrencies stretched beyond bitcoin.

Is Bitcoin being favored?

While the Trump administration’s move to establish a Strategic Bitcoin Reserve demonstrates the government’s recognition of Bitcoin’s increasing importance in the global financial system, any favoring of Bitcoin over other digital assets could have repercussions. By creating a separate “stockpile” of other cryptocurrencies, it seems the government has labeled bitcoin as “special”. One concern among experts is market distortion, as official political endorsement might signal to investors that Bitcoin is safer or a more legitimate investment.

This, in turn, could drive funds away from other cryptocurrencies as market sentiment towards altcoins turns risk averse. Others say this decision could simply be a way to draw in bitcoin holders, of Trump’s most loyal lobby groups, to the idea that large bitcoin purchases are on the horizon, when they will never actually materialize. The crypto market did not seem to flinch at the news, and held steady around $80,000 over the weekend of the 8th of March. Time will tell whether Trump’s Strategic Bitcoin Reserve will impact the market, or whether it will serve as a symbolic gesture with minimal real-world impact.

For more insights and reflections on crypto trends, trading, how to use Limitlex, or to open a trading account with us, visit www.limitlex.com.