Unknown page.

BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT  BTC

77073.42 EUR

BTC

77073.42 EUR  ETH

2624.13 EUR

ETH

2624.13 EUR  LTC

82.17 USDT

LTC

82.17 USDT  PROPT

21.930 USDT

PROPT

21.930 USDT  HOM

1.190 USDT

HOM

1.190 USDT

EU Based

Highly Secure

API Trading

Trading For Corporations

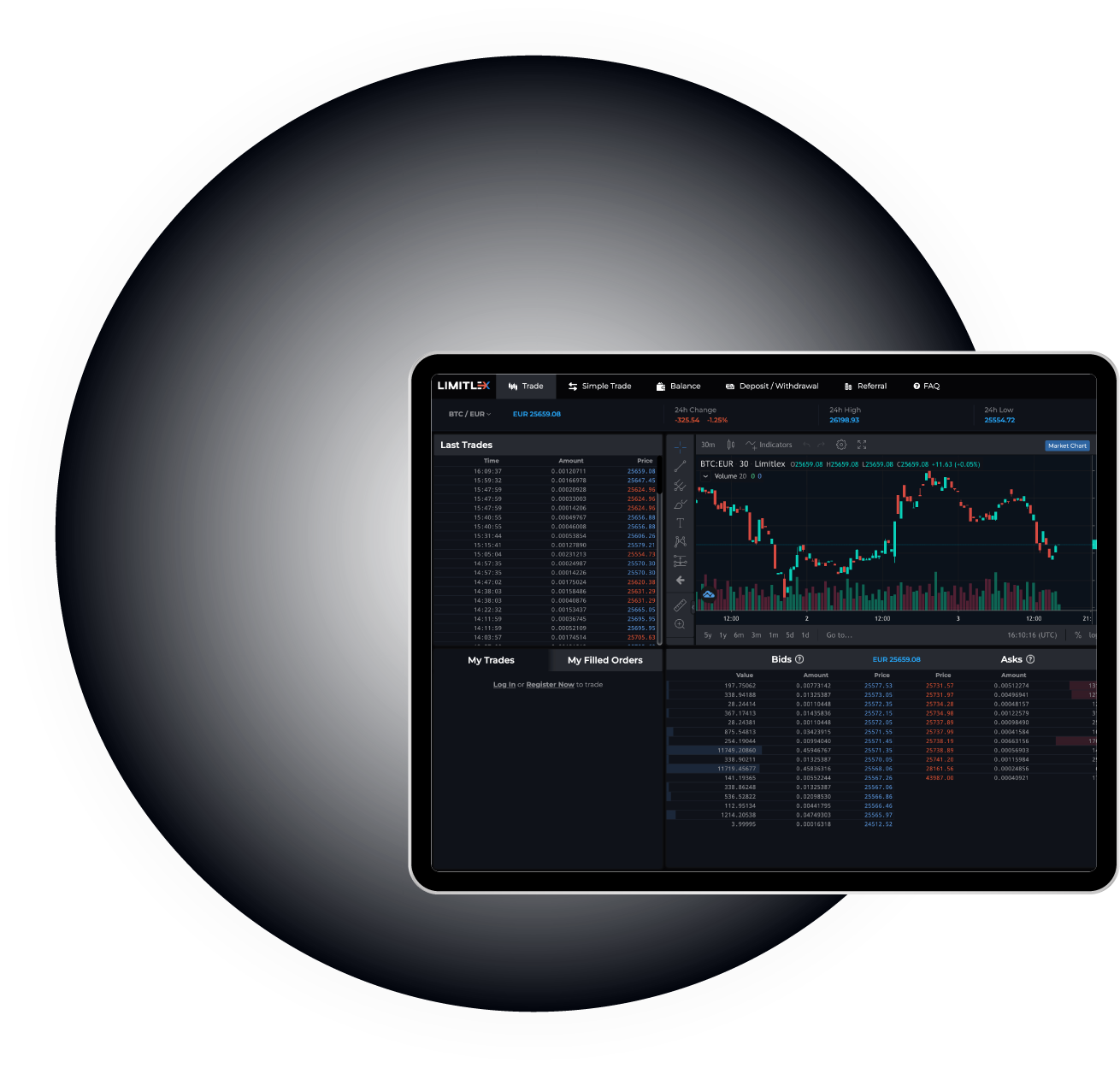

Limitlex is a user-friendly global crypto exchange offering secure, automated, and efficient trading of various digital assets with best execution rates in the market. Founded by experts, the platform supports individual, corporate, and institutional accounts. Backed by an international investment group, Limitlex aims to revolutionize digital asset trading by maximizing user profits and enhancing the overall experience.

Start trading

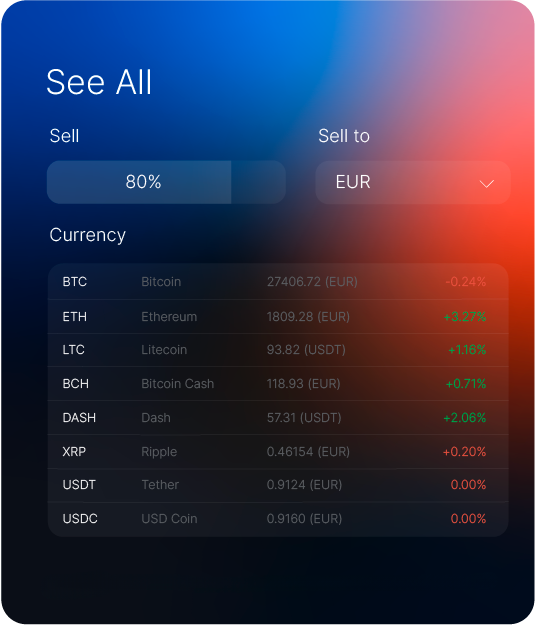

Basket Buy and Sell All streamline crypto trading. Basket Buy lets users purchase multiple cryptocurrencies in one click, allocating funds equally or by market cap. Subfeatures offer one-click buying of top cryptos or random selections. Sell All allows users to sell all or a percentage of their crypto portfolio for a chosen quote currency (EUR, USDT, BTC) with a single click.

Start trading

Basket Buy Order

Basket Buy Order Buy a basket of different cryptocurrencies with one click! Simply set the amount you want to invest and choose your desired type of selection: top coins by market cap, your own pick, or random choice.

Sell All Order

Sell All Order React quickly to bigger market movements and don’t waste your time with opening separate sell-orders for each of your cryptocurrencies. Sell them all (or a percentage of each) with one click!

Orders Notifications

Orders Notifications Real-time notifications on your filled orders allow you to react quickly and use your funds to make further actions on the market without delay. Receive your order notifications by email or Telegram.

EUR pairs

EUR pairs Limitlex now allows for trading directly between cryptocurrencies and Euro with competitive execution rates! Make Euro payments and withdrawals from/to your SEPA-based bank account.

Trade New Tokens

Trade New Tokens We list interesting new tokens for which we deem give valuable opportunities to our users. Prior to listing, we conduct a thorough due diligence on the token’s project, team, and reputation.

Execution Rates

Execution Rates With AI-driven market making and order-book optimization tools we are able to provide our users with markedly competitive execution rates on the listed pairs.

Based out of Slovenia, our diverse team of experts collaborates to create a Smart Digital Asset Exchange, focusing on innovative strategies for a superior user experience. We prioritize user needs, security, and data privacy while delivering quality service and maintaining ethical practices.

Earn long-term passive income! 35% commission payouts from your referred users.

Join

The bid price is the highest price that a particular buyer is willing to pay for a specific product or service. In the context of financial/crypto markets, it is the value buyers offer for an asset, such as a commodity, security or cryptocurrency.

The asking price is the minimum price that an individual would be willing to sell their asset, or the minimum amount that they want to receive in return for the unit(s) they are parting with.

Here you can see all of your open orders. To cancel an open order, just click the ‘X’ symbol next to it.

Limit order gives you the power to set a specific price at which you would like to buy or sell the desired amount of cryptocurrency.

A market order is an order type that enables you to buy or sell at the best available market price.

A Stop Loss Limit order is designed to limit your loss on a cryptocurrency position. A Stop Loss Limit order can be placed to buy or sell a specific cryptocurrency at your entered price (a limit order) once that cryptocurrency reaches a certain price.

A take profit limit order is an order put in place by traders to maximize their profits and protect their profits on positions. A take profit limit order allows you (a trader) to set your custom made Buy or Sell order. You have to set two prices - the Trigger Price and the buy/sell Price.